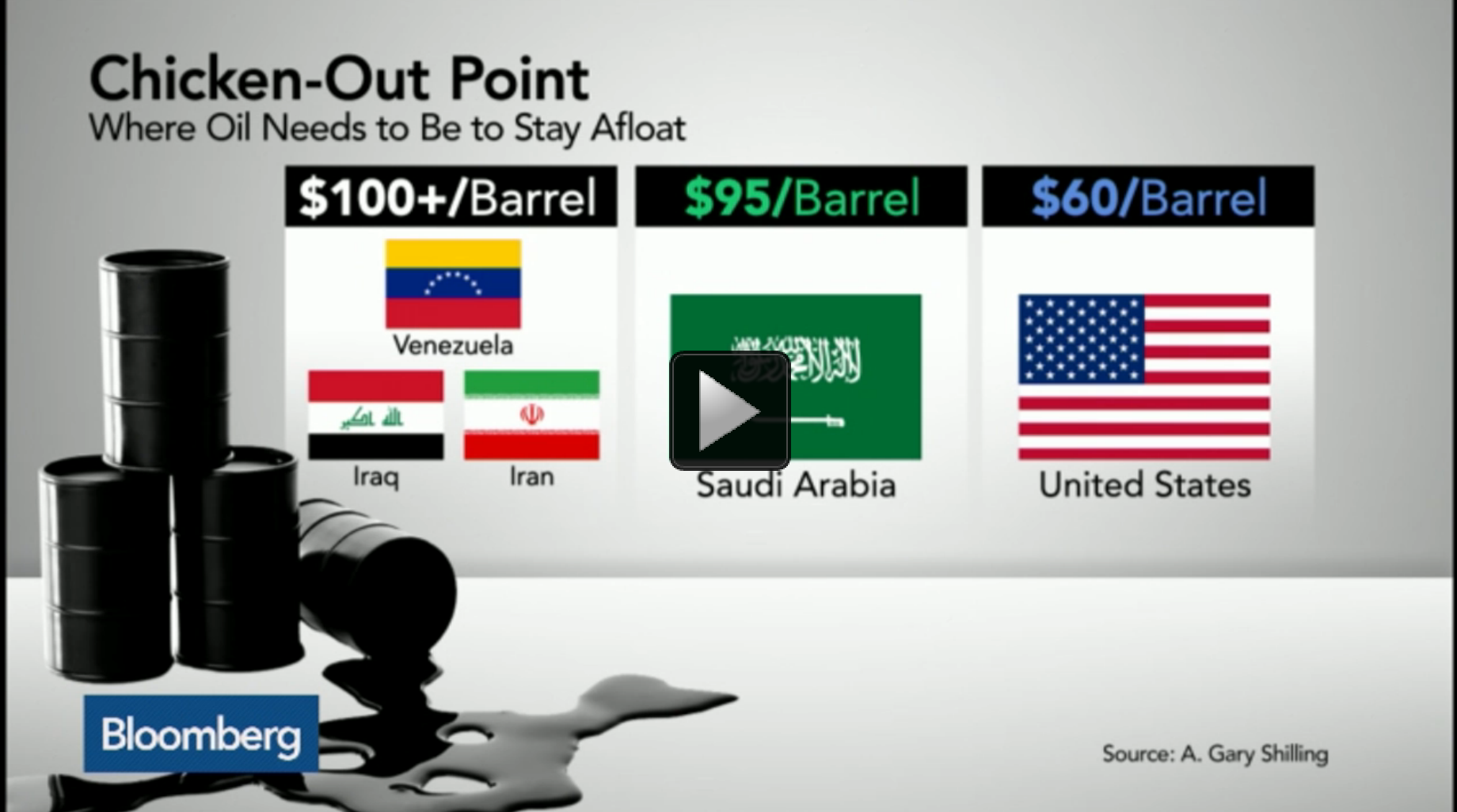

Betting on a rebound in energy (and realty) prices from here, is a bet that global demand is strengthening not weakening. The trouble is, evidence of strength is scarce, to say the least. The Bloomberg clip below, offers an enlightened discussion on the deflationary forces of both excess supply and weak demand now sweeping the world. As Gary Shilling reminds here, the need for cash flow keeps levered producers pumping supply as prices fall, which naturally leads to even lower prices. At 7:20 in this segment, he offers a rationale for why $10/barrel oil may be in the cards. Important to note, oil shocks come from sudden plunges in price, not just spikes…

Gary Shilling, president of A. Gary Shilling & Co., and Wilbur Ross, chairman of WL Ross & Co., talk about the U.S. housing market and oil prices. Here is a direct video link.

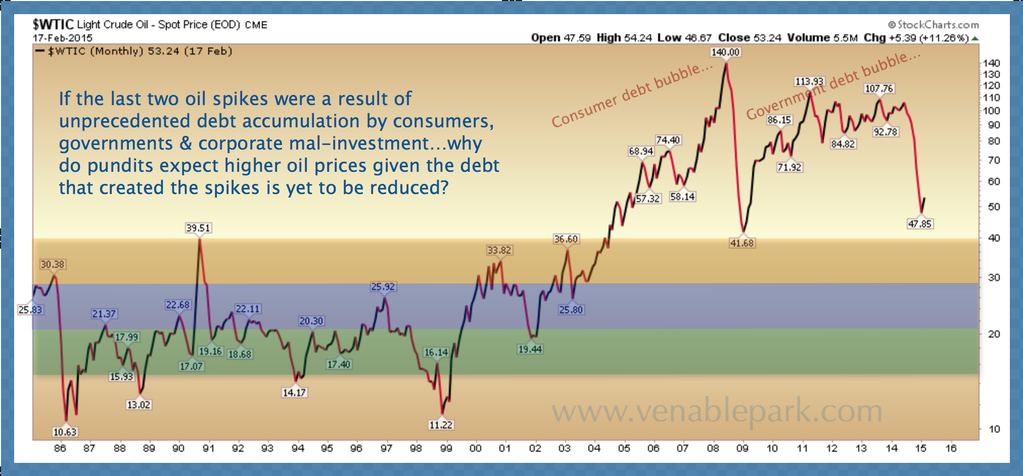

Keeping oil anywhere north of $40 (brown band below) may prove quite challenging, given the back-to-back epic debt bubbles (marked below) that pushed it up, are now unraveling, and the weight of that debt is now likely to serve as an equal and opposite force in the other direction.

Keeping oil anywhere north of $40 (brown band below) may prove quite challenging, given the back-to-back epic debt bubbles (marked below) that pushed it up, are now unraveling, and the weight of that debt is now likely to serve as an equal and opposite force in the other direction.