You have to chuckle at the consensus of financial commentators. The same crowd who confidently and incorrectly predicted rising inflation, rising commodities, falling US Treasury bonds and a falling US dollar are now busily morphing their forecasts on all these things in real time with the price of oil. Very helpful (not).

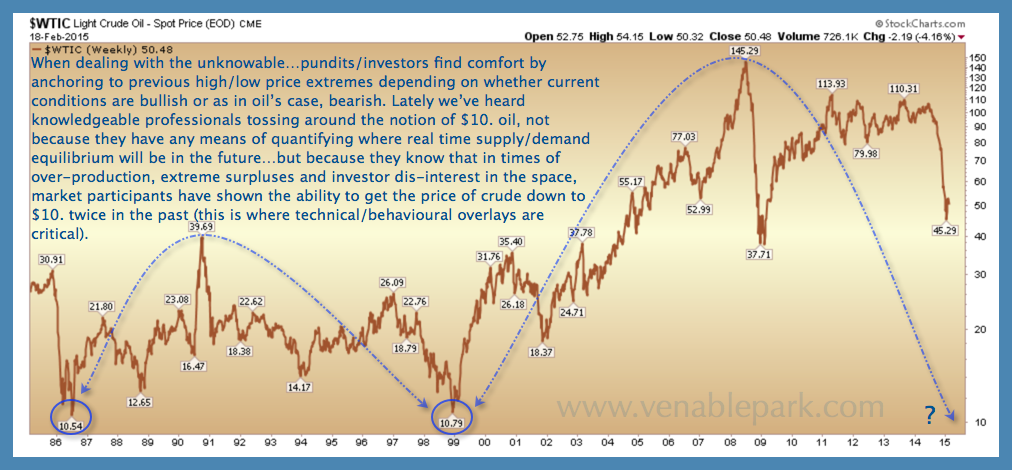

The latest round has several previous bulls now talking about the prospects of oil at $10-$20 a barrel. As shown in my partner Cory’s chart below, $10-$20 is a possibility driven by the mean reversion of crazy leverage that has been directed into the energy (and other commodities) sector over the past decade. But we have been making that, previously, wildly contrarian, observation since global demand peaked and turned down in 2011.

Moreover, there is a similarly strong probability of knock down effects to other highly levered asset classes such as equities and corporate debt, as commodities deflate. Of course, almost none of the now capitulating inflation bulls are forecasting downturns in these other assets. Yet. Investment sales needs to keep selling its bread and butter products after all…

Moreover, there is a similarly strong probability of knock down effects to other highly levered asset classes such as equities and corporate debt, as commodities deflate. Of course, almost none of the now capitulating inflation bulls are forecasting downturns in these other assets. Yet. Investment sales needs to keep selling its bread and butter products after all…