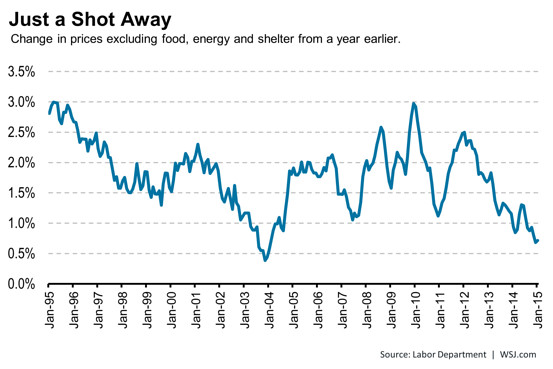

Janet Yellen tried to sound confident yesterday that the US economy was strengthening and that the Fed would be able to exit crisis mode, and begin edging policy rates back up from (6 long years) near-zero within the next 6 months. But then she also presupposed that the central bank will be achieving its target inflation rate of 2%…and there is no evidence of that so far. At all.

The consumer-price index, which measures what Americans pay for everything from shirts to haircuts, fell a seasonally adjusted 0.7% in January from December, the Labor Department said Thursday. From a year earlier, prices declined 0.1%. It was the first year-over-year decrease since October 2009. See: Gas drop drives US into deflation territory.

In fact when we consider the spillover effects from a rising US dollar (which is importing deflation from other export-desperate countries) and the deflationary impacts of falling commodities that are feeding into lower prices for many goods, on top of older folks buying less and debt levels stifling the masses, it’s pretty hard to see the inflation cavalry riding to the rescue any time soon here. Today’s price pressures are looking positively anemic.

Good for struggling consumers to get a price break on goods and services…but bad for companies planning on growth…so bad for employment…and bad for individuals, corporations and governments (not just Greece) who are trying to repay loans on stagnant and falling incomes… so bad for banks who have lent obscene amounts. And positively horrifying for central banks who have helped to lead the world into this deflationary trap and find themselves for the first time ever, facing a global recession with no interest rate room to ‘stimulate’ growth and no credibility left. The history books are unlikely to look kindly on their ‘genius’.