This morning more dour news for Canada: Canadian Wholesale Sales in January fell by the most in 6 years and oil and most other commodities are continuing their downdraft on tumbling global demand and soaring inventory. West Texas Crude (WTI) is flirting with a fresh cyclical low around $42 a barrel and the once hot, and commensurately over-valued Calgary realty market, has begun its comeuppance.

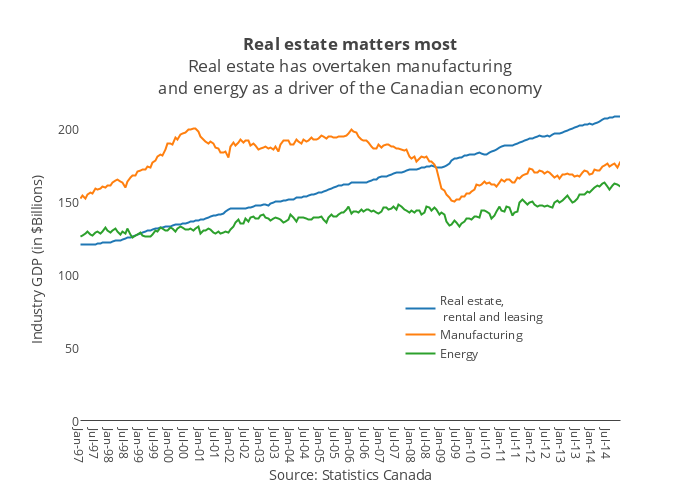

Energy accounts for some 10% of Canadian GDP directly (significantly more indirectly) and it is in full on contraction. Manufacturing that never did recover from the 2008 recession, is not picking up the slack so far, despite the plunging loonie. This leaves bullish bets focused on the last leg of the Canadian growth stool: the most over-valued sector in the land. Indeed one of the most over-valued in the world: Canadian real estate. Recently accounting for 13% of Canadian GDP, continued strength here is critical.

The trouble is that in order for Canadians to keep consuming and maintaining their outrageously overvalued real estate they don’t just need a continuation of low interest rates, they need income. And income comes from jobs. And jobs are in retreat. See: Never mind oil. If housing goes bust, we’re screwed.