US margin use (borrowing to buy securities) peaked this cycle in February 2014 and has moved ever so slightly lower since. Historically when margin balances stop expanding, they begin contracting and bear markets have followed within a matter of months. We saw this pattern (margin debt in red, S&P 500 price in blue, below) in both 2000 and 2007.

This is a graph of classic ‘investor’ behavior: as prices rise, people become more confident (and reckless) and start borrowing money in an effort to increase their exposure to market gains. Unfortunately this also increases their exposure to market losses; and when the ‘hottest’ sectors inevitably sell off, asset values fall and margin calls commence, setting off a cascade of forced selling as holders must liquidate assets and pay back the debt. Anyone who has ever witnessed this cycle first hand, can attest to its awesome capital incinerating effects.

This is a graph of classic ‘investor’ behavior: as prices rise, people become more confident (and reckless) and start borrowing money in an effort to increase their exposure to market gains. Unfortunately this also increases their exposure to market losses; and when the ‘hottest’ sectors inevitably sell off, asset values fall and margin calls commence, setting off a cascade of forced selling as holders must liquidate assets and pay back the debt. Anyone who has ever witnessed this cycle first hand, can attest to its awesome capital incinerating effects.

Even worse, and sometimes on top of margin loans(!), some mortgage their homes to buy stocks and mutual funds (typically after they have already been rising for years). Usually the ‘strategy’ is recommended by the loan sellers and broker/dealers who make rich commissions when they do. (No conflicting interests there of course…)

In any event, borrowing to ‘invest’ in financial markets is a very risky bet at the best of times, but doing so when market assets are at all time highs is financially suicidal. Why not mortgage your house to buy lottery tickets while you are at it?

Apparently already debt-drenched Canadians, are oblivious to these facts. See: Canadians find new way to binge on debt as borrowing to buy stocks hit record levels.

If you know anyone that is doing this today, send them this article before it is too late. Honestly, this is a front seat on the next financial trainwreck. Run, don’t walk. To wit:

Dennis Colpitts could pay down the mortgage on his house in western Canada early if he wanted. He’s investing in the stock market instead — and in some cases borrowing to do so.

With a mortgage rate of 2.35%, Colpitts said it makes more sense to put his money into stocks or other investments that hold the potential for higher gains. He primarily invests in exchange-traded funds, including through a margin account, which allows him to borrow money from his broker to buy securities.

“I could liquidate all my stocks and ETFs and put them into my mortgage, but I don’t,” said Colpitts, 39, a technology consultant who lives with his wife and two children in Calgary. “I keep them with the hope of getting my 6 or 7% return.”

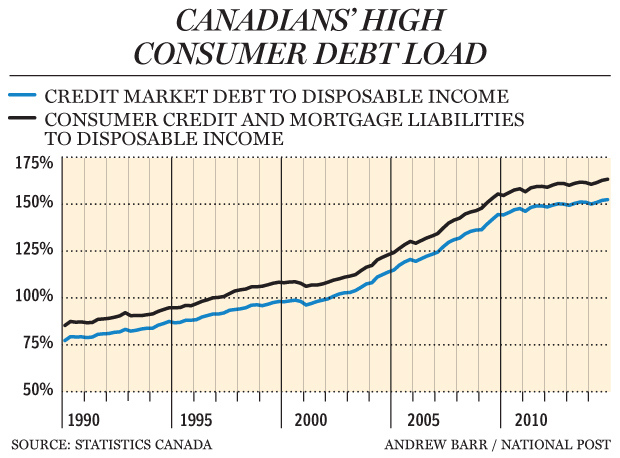

Canadians like Colpitts are borrowing to invest at the highest level since at least 2000, racking up more than $19 billion on margin in January. That’s helped fuel a 37% surge in mutual-fund assets in the past two years and a 41% rise in ETF assets. The figures illustrate Canada’s rock-bottom interest rates aren’t only fuelling house prices and consumer debt to record highs, they’re enticing people to leverage in financial markets.