This line of relentlessly increasing college costs has only been possible thanks to the second line shown below of galloping student loan growth that governments have been underwriting. It is time for a new model that focuses less on flashy real estate, stadiums and high paid administrators, and more on efficient and affordable education delivery.

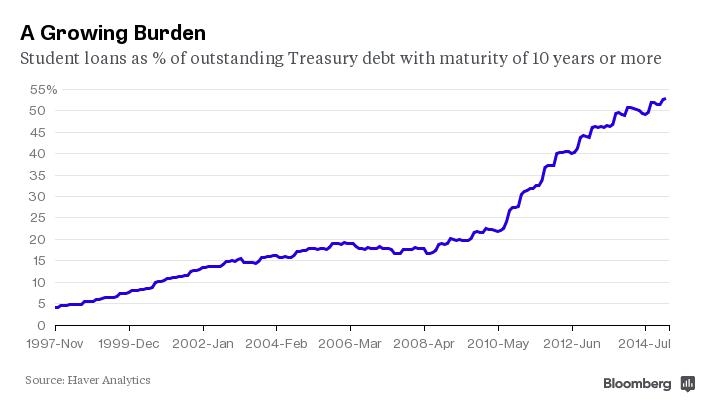

Here is the student debt that has enabled the relentless expansion in education costs. Note the parabolic explosion since the 2008 recession.

Here is the student debt that has enabled the relentless expansion in education costs. Note the parabolic explosion since the 2008 recession.

Whose best interests is this serving again?? Certainly not students who come out of school mired in debt to find weak job markets, dominated by working-longer-Boomers, and flat wage growth when they do find work.

Whose best interests is this serving again?? Certainly not students who come out of school mired in debt to find weak job markets, dominated by working-longer-Boomers, and flat wage growth when they do find work.

It’s certainly not good for taxpayers either. See: The US government’s $800 billion gamble on student loans.

There’s already almost $800 billion in student loans that’s directly on the government’s balance sheet, according to Wall Street experts who advise the U.S. Treasury on its borrowing strategy. And that represents a ballooning share of the debt that the government has issued. Student loans loans in February were worth more than half the value of outstanding Treasury debt with a maturity of 10 years or more.

“If you were fairly confident that all those loans are going to be paid back, then it wouldn’t be that big of an issue…But I think the problem is that we’ve got double-digit delinquencies on student loans, and the problem only seems to be getting worse.”

Data from the Federal Reserve Bank of New York show that 11.3 percent of student loans were delinquent in the final three months of 2014, up from 11.1 percent in the prior quarter…

“If there are a lot of defaults, that would impact the fiscal situation, because the taxpayer would lose money in that deal.”