Since Canadian oil sands benchmark Western Select Crude (WCS) sells at a discount of 25%+ to West Texas Crude (WTI) (see here), Canada has the distinction of producing the lowest valued oil in the world. Due to high monetary costs of production it is also some of the least profitable, and that is just in terms of the costs that are officially counted. (For a 7 minute Greenpeace video report on the many costs of oil sands production that are not included in current profit and loss statements, see here.)

A recent Canadian Energy Research Institute (CERI) study put the West Texas Intermediate (WTI) break-even price for existing steam-driven oil sands projects at $84.99 a barrel and $105 for new mines. See: Is oil sands development still worth it? Today WTI is trading around $50/barrel.

Despite negative returns at current prices, a report from the National Energy Board projects that Canada’s oil output is set to climb to 3.89 million barrels a day this year, mostly driven by oil sands producers, whose output will increase 8.3% (upgraded synthetic crude included). The Financial Post reports that a total of 14 new oil sands projects are scheduled to start in 2015–36% more than in 2014.

Proponents (including Canada’s federal government) argue that the downturn in oil will be short-term and that production should continue to be ramped–necessary short-term pain for expectations of longer term profits.

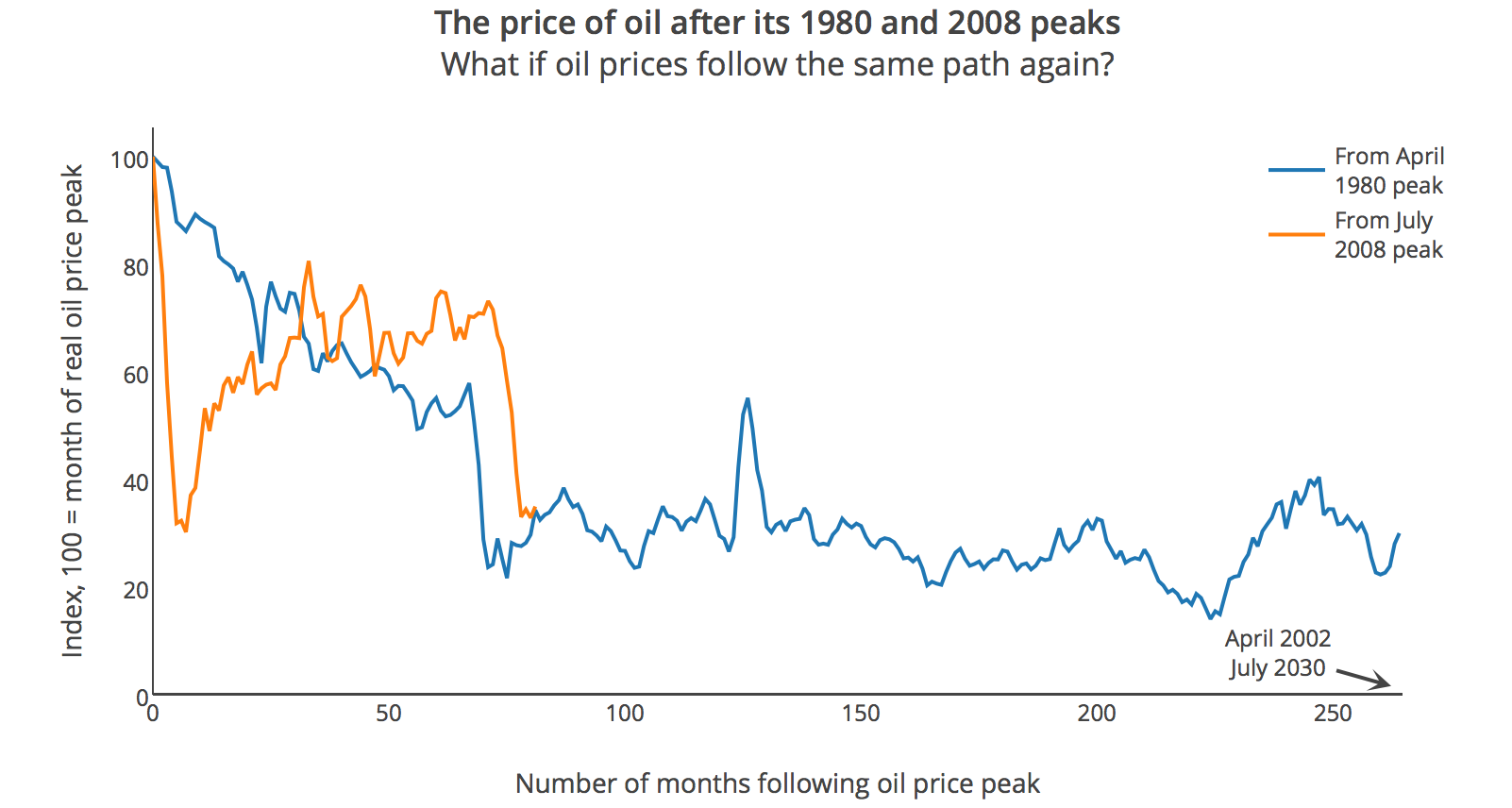

The truth of course, is that no one can know for sure what will happen to prices next. However, secular boom cycles in energy have historically been followed by long periods of secular decline, and it is probable that this one will prove no different. Indeed thanks to the record over-investment of the latest credit bubble, the mean reversion this time should arguably be deeper and longer than usual.

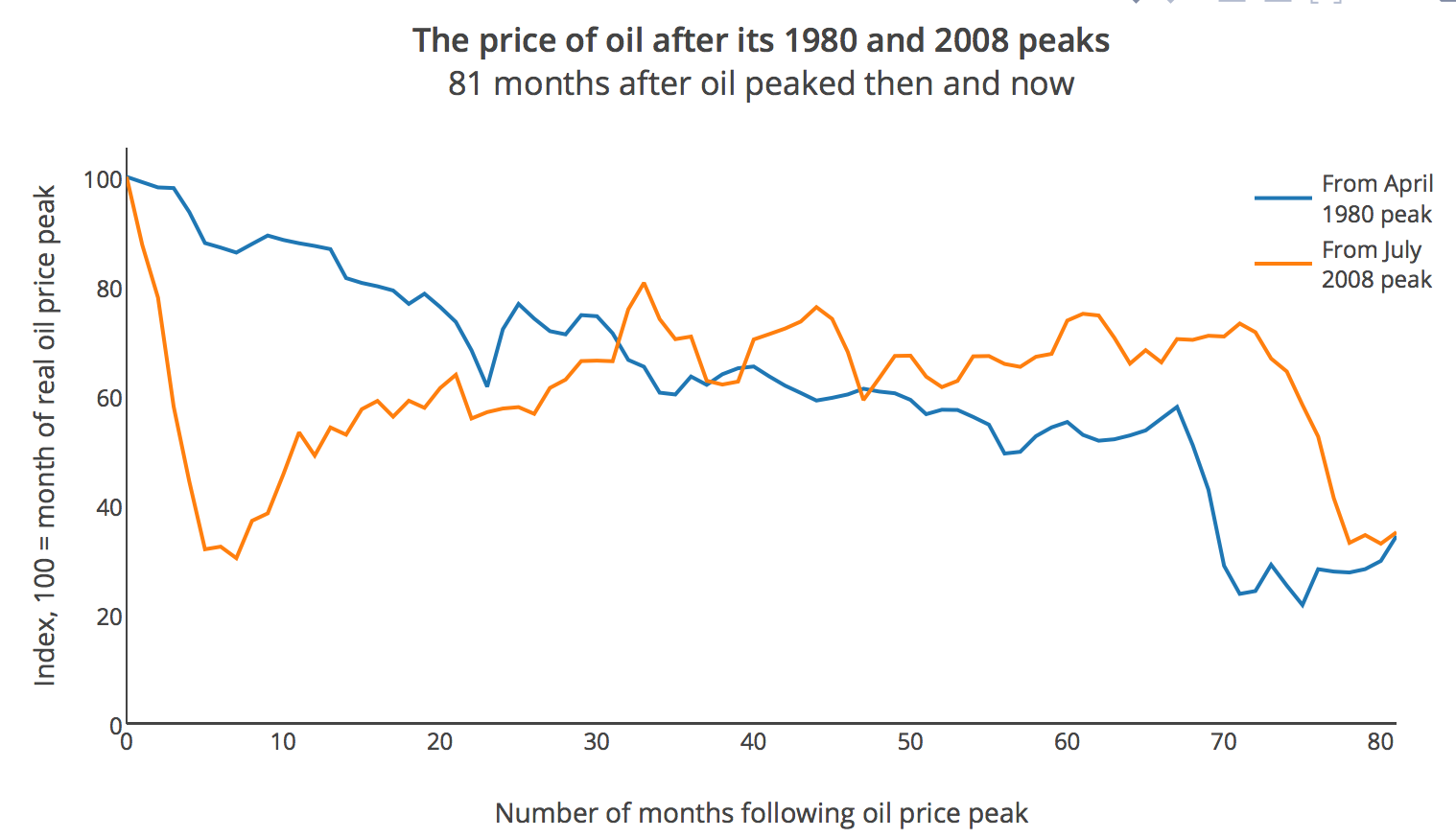

The price action for WTI over the past 81 months since July 2008 certainly so far resembles the price action in the 81 months that followed the last secular peak in April 1980 as shown below. See: Its crazy how close oil has tracked the 1980s crash

The question now, is whether it will continue to follow the downward trend over the next 10+ years as it did following the 1980 peak and bust. There are many reasons to think that it could.

The question now, is whether it will continue to follow the downward trend over the next 10+ years as it did following the 1980 peak and bust. There are many reasons to think that it could.