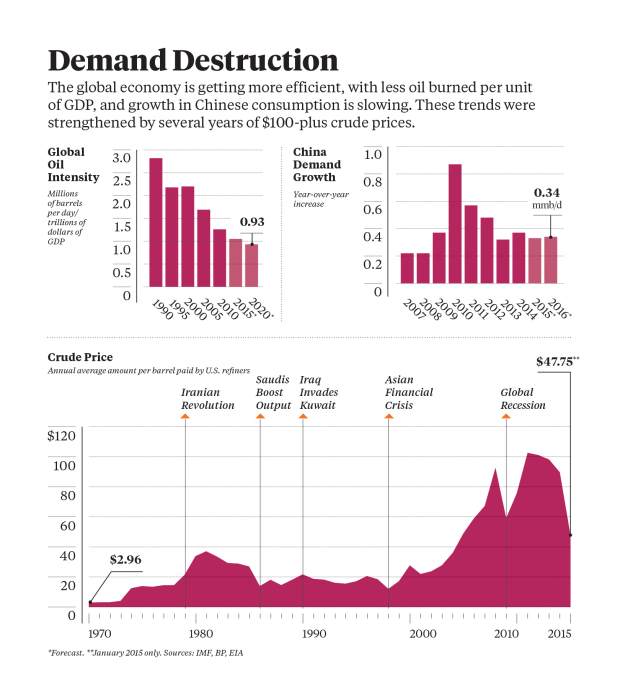

Oil bulls miscalculated when they figured on the human race having an insatiable demand for oil. To the contrary, the edging out of costly, inefficient, dirty energies, is the natural evolution of a steadily advancing society. This is something forward thinkers could see coming.

A benefit of the credit bubble is that it rapidly accelerated energy innovations and new supply through massive capital flows into the space. At the same time, it brought forward years of consumption demand from the future, as consumers binged on credit in the now. In the process we now have falling demand and still galloping supply of all different types of energy. This is a world-changer. See: Saudi Arabia was worried about a danger much bigger than shale when it blindsided oil markets:

“Naimi and other Saudi leaders have worried for yeas that climate change and high crude prices will boost energy efficiency, encourage renewables, and accelerate a switch to alternative fuels such as natural gas, especially in the emerging markets that they count on for growth. They see how demand for the commodity that’s created the kingdom’s enormous wealth—and is still abundant beneath the desert sands—may be nearing its peak. This isn’t something the petroleum minister discusses in depth in public, given global concern about carbon emissions and efforts to reduce reliance on fossil fuels. But Naimi acknowledges the trend. “Demand will peak way ahead of supply,” he told reporters in Qatar three years ago.”

Just one of countless global examples, manufacturing powerhouse Germany, has gone all in on the energy revolution. Last year, 26% of Germany’s power supply came from renewable sources, by 2050, the figure is targeted to rise to 80%, and developments are now coming faster than forecast. See: Germany recharged: EU powerhouse goes all in on alternative energy.

Just one of countless global examples, manufacturing powerhouse Germany, has gone all in on the energy revolution. Last year, 26% of Germany’s power supply came from renewable sources, by 2050, the figure is targeted to rise to 80%, and developments are now coming faster than forecast. See: Germany recharged: EU powerhouse goes all in on alternative energy.

And as for how to store the world’s many sources of renewable energy, that too is racing ahead in leaps and bounds. This is far bigger than the ‘race to the moon’ for mobilizing governments, investors, scientists, companies and consumers behind a common goal. See: The 5 billion dollar race to build a better battery.

Wind turbines accounted for 45 percent of new U.S. power production last year, while solar made up 34 percent of fresh capacity worldwide. Storing this energy when the sun isn’t shining or a breeze isn’t blowing has remained an expensive hurdle. Battery believers say that’s changing. They’ve invested more than $5 billion in the past decade, racing to get technologies to market. They’re betting new batteries can hold enough clean energy to run a car, home, or campus; store power from wind or solar farms; and make dirty electricity grids greener by replacing generators and reducing the need for more fossil fuel plants. This market for storage capacity will increase almost 10-fold in three years to 2,400 megawatts, equal to six natural gas turbines…new batteries emerging with the help of big backers will finally enable renewables to compete with fossil fuels. “Khosla, Gates, Musk, and the Pritzkers are all excited about changing the world in a better way, and they’re swinging for the fences…”