Today we have ‘official’ reports that in Q1, China’s economy (the world’s second largest) slowed to a 7% annualized growth rate from Q1 2014, down more than 50% from its 14.2% peak rate in 2oo7, and the slowest year over year pace since the global recession in 2008-09 when it dipped to 6.6% in Q1 2009.

This has made some giddy about the prospects of even moar (!) ‘stimulus’ efforts from the government. Trouble is, as in the rest of the developed world, Chinese stimulus spending since 2008 has already greatly degraded the nation’s balance sheet and monetary fire power. The destabilizing effects of too much debt are already undermining the economy.

Economist George Magnus discusses the downside risks for China and the world amid mean reverting growth and bubble valuations in stock and real estate markets.

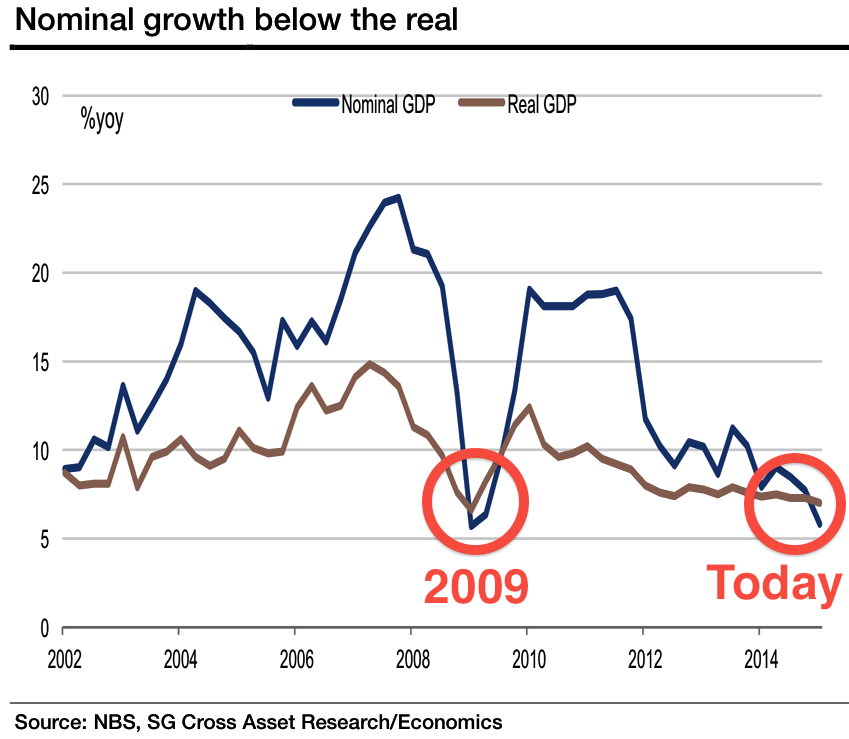

Also see: China charts scream 2009 all over again . Here is a sample…