According to 2013 data, globally the coal, oil and gas industries benefited from subsidies of $550bn, four times those given to renewable energy. And here’s a stat that Obama watchers can chew on: although in 2009, President Obama called on the G20 to eliminate fossil fuel subsidies, since then US federal subsidies have actually risen by 45%. As we head into North American election years, good to be reminded that campaign speeches and official actions typically have a negative correlation.

A Guardian investigation of three specific projects, run by Shell, ExxonMobil and Marathon Petroleum, found that the subsidies were all granted by politicians who received significant campaign contributions from the fossil fuel industry. See: US Taxpayers subsidizing world’s biggest fossil fuel companies. (no surprise there).

Limited taxpayer funds being diverted to enrich the largest, most profitable sector in the world is indefensible any day of the week –what about all that capitalist, survival of the fittest rhetoric, folks? But it’s especially undermining when so many life-improving innovations are fighting to get a foothold in a rigged competition. Further, when one considers the exponential costs that fossil fuels are compounding on to the world in unnecessary military operations, wars, environmental devastation from extraction and spills, carbon and toxin emissions, wasted water, as well as consumer funds burned in fuel costs that could be saved (through sustainable energy use) and allocated to a 100 other life-enriching areas, one realizes the madness of present policies.

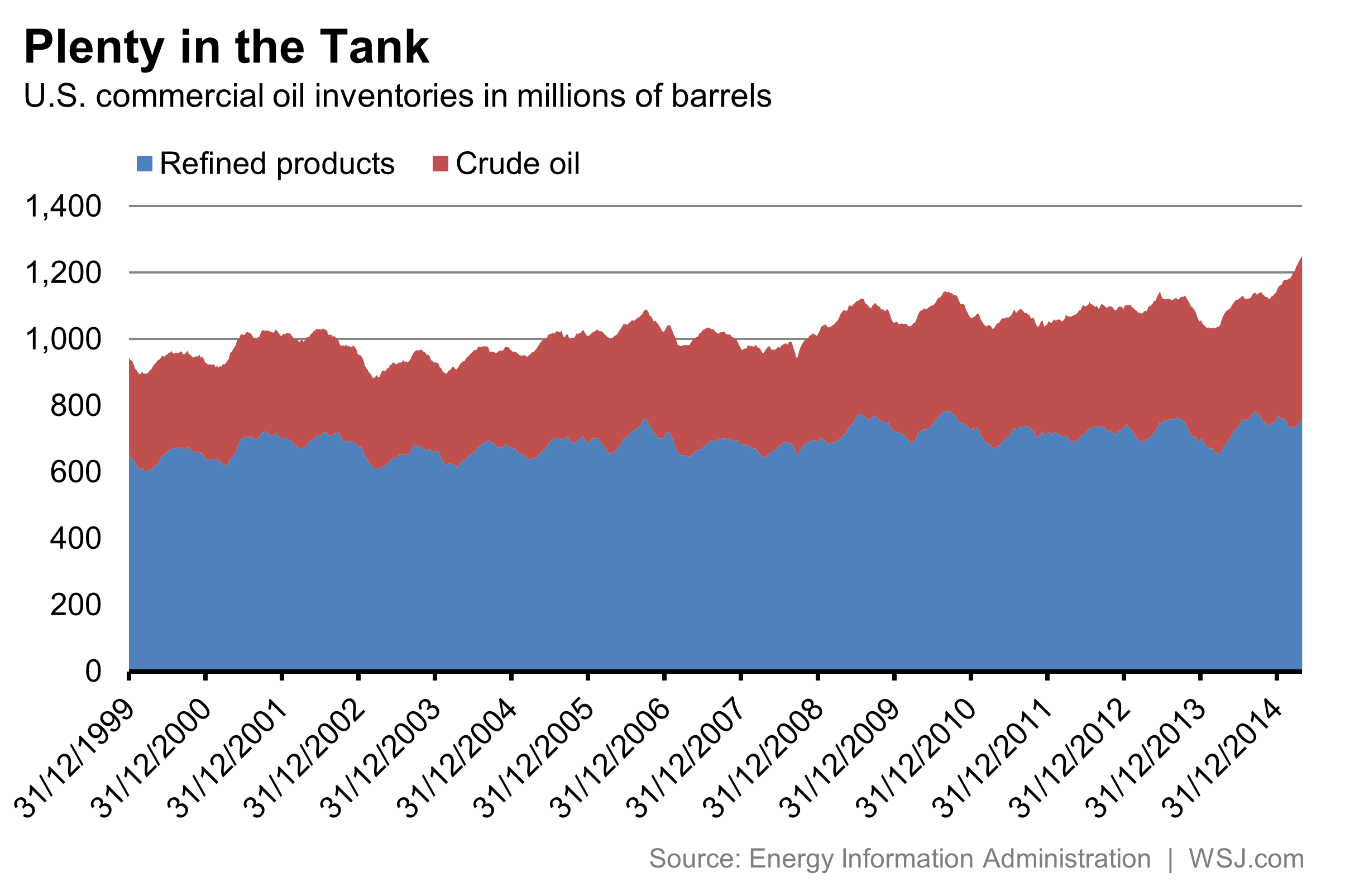

What’s more we are literally overflowing in fossil fuels today.

Despite record inventories in February, levered traders pushed commodity prices sharply higher over the past 2 months, enticing global production up to fresh all time highs in April. None of this is doing any favors for producers or investors in the space of course, although a lasting period of lower prices will help consumers pay down more debt.

See Oil Markets: Use your illusion:

Barclays points out that net speculative length in Brent crude futures has doubled since the start of the year to its highest level since data began being collected in 2011. A similar move has been seen in copper, despite that metal’s even higher exposure to a slowing China. Investor dollars have also surged into oil-linked exchange-traded funds since the start of the year.

The impression, then, is of a crowded speculative bet on oil, alongside other commodities, that is disconnected from the ongoing build-up in spare barrels. When the spell breaks, the drop could be swift.