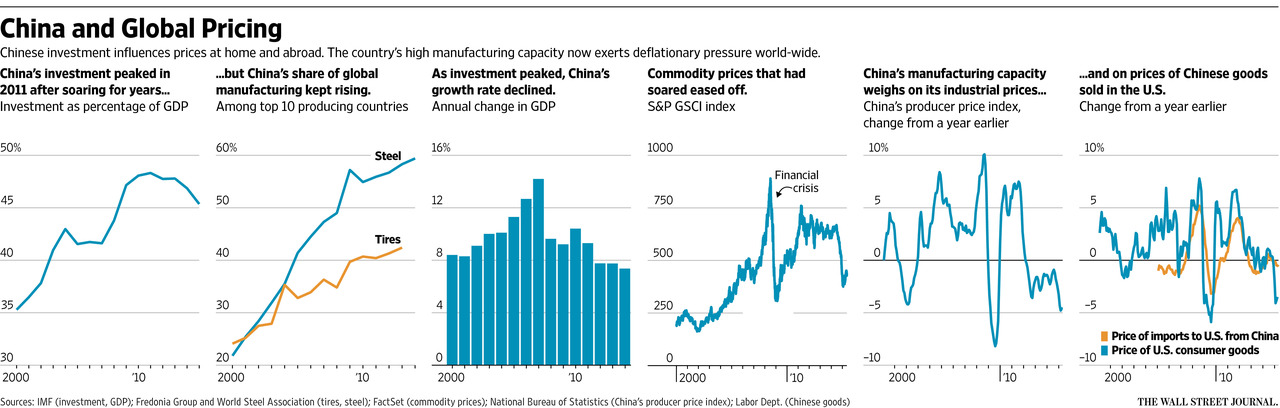

It is not just oil that’s in a supply glut. Plants the world over keep pumping out products as growth falls, fueling deflationary pressures world-wide. See: Glut of Chinese Goods pinches Global Economy

“A tremendous amount of capacity came on line [in China] before people realized it wasn’t sustainable, by then, it was too late.” –Del-Nat Tire CEO, Brian Grant

Global deflationary pressures emanating from China are symptomatic of wider demand issues gripping economies from South America and Europe to much of Asia. China is far from the sole cause of price weakness; others include new crude-oil supplies in North America and sluggish growth in Europe. But China’s sheer size, reach and central role in global manufacturing make it a potent force…

After tax corporate profits divided by nominal GDP (sales) that rebounded sharply after the 2008 recession, peaked at an all-time high of 10.06% in Q4 2011 and have been falling since (notwithstanding hundreds of billions in share buybacks to ‘engineer’ earnings in the short run). Most recently at 7.97% (below), see: Corporate profit margins are coming back down to earth, profits still have significantly further to mean revert before restoring their long term average growth rate of 6% (and history tells us profits always do mean revert).

For cash-strapped, under-employed consumers, lower prices help. But for previously revered financial policy makers and corporate executives (US CEO pay reached a record 354x the average worker pay in 2014, vs. 20x in 1965) price deflation is a game changer. After all, MBA theories, spreadsheets and executive pay structures are all predicated on assumptions of annual price inflation. Price deflation turns confident financial forecasts and models upside down. After years of reckless leverage on leverage, global growth is now in pay back mode.

For cash-strapped, under-employed consumers, lower prices help. But for previously revered financial policy makers and corporate executives (US CEO pay reached a record 354x the average worker pay in 2014, vs. 20x in 1965) price deflation is a game changer. After all, MBA theories, spreadsheets and executive pay structures are all predicated on assumptions of annual price inflation. Price deflation turns confident financial forecasts and models upside down. After years of reckless leverage on leverage, global growth is now in pay back mode.