With the Japanese Yen breaking its 30-year support of Y122/$ last week, the rest of the world’s exporters are under intense pressure to further weaken their own currency and/or lower prices to keep selling goods. The net effect unleashes the next round of currency wars as everyone fights for their piece of reduced demand following the consumer credit bubble. It also means deflationary pressures are gaining momentum.

Lower prices allow cash strapped masses to afford more, but they are generally negative for sales and earnings numbers (and stock and corporate debt prices at record valuations) as well as for the world’s many highly indebted corporations, governments and people who are trying to service loan repayments with shrinking cash flow.

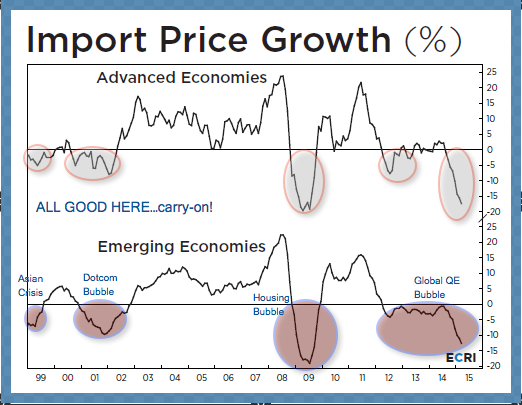

All is not well on the global growth front, no matter how much the risk-sellers insist that the real economy is getting ‘better’ and that central banks are in control of everything. They said the same thing in each of the shaded areas marked below and each time financial markets experienced major price shocks.