“A new report from National Bank Financial shows a record number of condos in the Greater Toronto Area were empty in May.

“A new report from National Bank Financial shows a record number of condos in the Greater Toronto Area were empty in May.

National Bank says more than 2,800 condos were available last month to be sold or rented based on information collected from the Canada Mortgage and Housing Corporation and the Toronto Real Estate Board.”

But no cause for alarm according to industry analysts, see, Real Estate Watch: surge in Toronto condo vacancies is not concerning. Don’t worry, be happy?

The path of the Canadian dollar now rides on the mean reversion of the secular boom that began in 2001 in commodities, household debt and real estate.

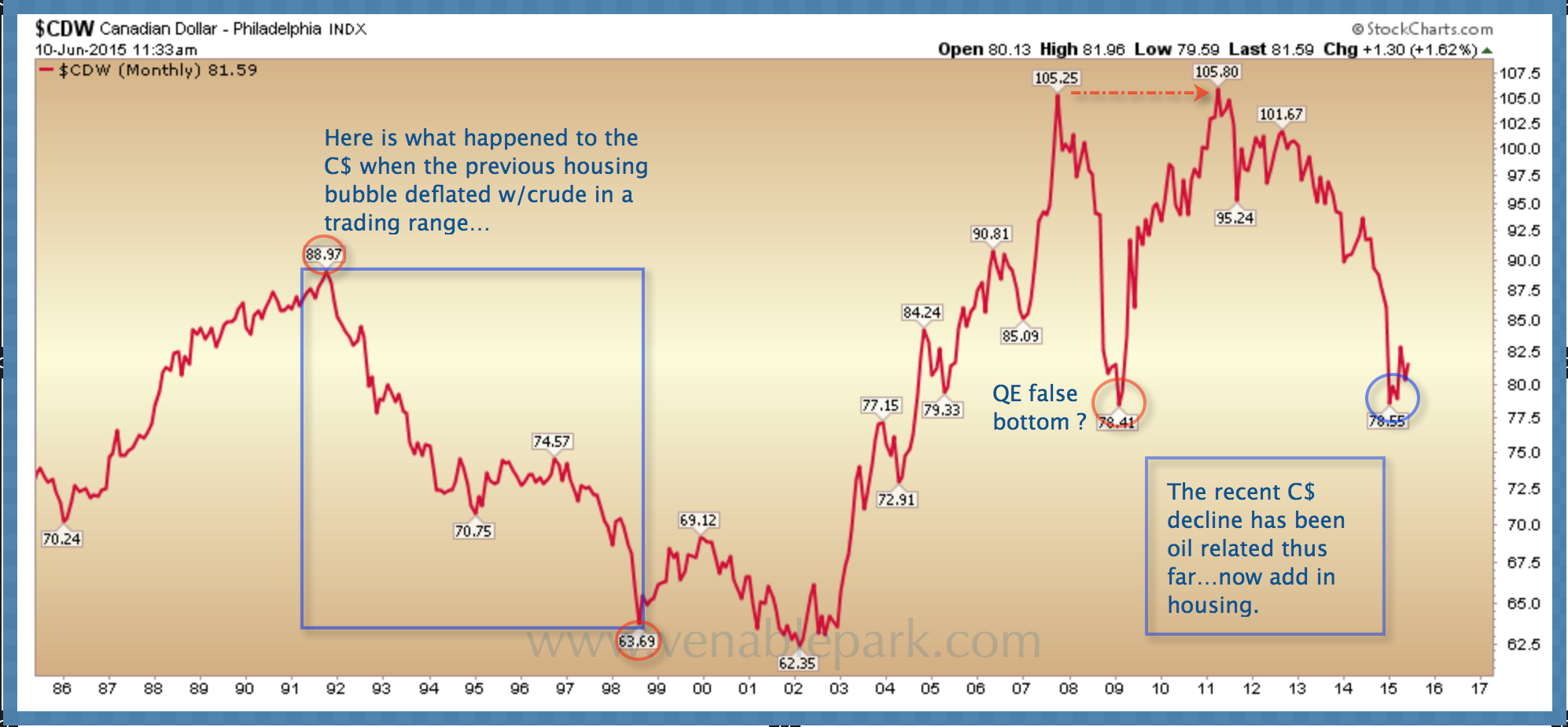

The following chart shows the Canadian dollar since 1985 and its price path after the last domestic boom in real estate peaked in 1990 and recession began (large box on left).

Oil lost 75% of its value from $40.65/barrel for WTI in 1990 to $10.82 by 1998 and the Canadian dollar and realty prices slumped along with it for 10 long years, before entering the next secular boom phase that began in 2oo1 and ran for a decade into 2011.

A distinguishing feature between the 2002 loonie bottom and today is that housing had floundered for a decade coming into 2002. Hot money flows coming out of Japan and into North America in the late 80’s (similar to hot flows fleeing China in the recent cycle), helped to balloon real estate prices and leverage; and Canadian households spent the next decade declaring bankruptcy, working down debt and re-building savings. At the same time, Canadian 5 year mortgage rates were 8% in 2000. As rates fell over the next 15 years, Canada entered a synchronous secular boom in both commodity exports (to 2011) and household spending (t0 2015).

Fast forward and today the oil (WTI) price has mean reverted some 60% from its 2008 high and the Canadian dollar has so far, fallen 22%. The trouble is that home prices and credit abuse in Canada today remain at all time highs. See: Canadians borrow more than $10 billion annually for home downpayments, for more gruesome details.

The secular mean reversion in commodity prices, spending, credit abuse and realty prices, is likely to persist for several more years and take an extended toll on the Canadian economy and its still jubilant housing sector. It is hard to believe then, that the loonie has seen its bottom yet this cycle.