The most recent Federal Reserve Bank of New York update calculates total US student loan debt at an eye-popping record, $1.16 trillion at the end of 2014. Just under half of those loans are owed to the US government.

As shown here, student loans now represent 48.5% of all the financial assets held by the US government–by far the largest asset on its books–7.5x larger than the 6.5% in mortgages outstanding and 5x the size of taxes receivable at 9.7%.

48.5% of all the financial assets held by the US government–by far the largest asset on its books–7.5x larger than the 6.5% in mortgages outstanding and 5x the size of taxes receivable at 9.7%.

This is not what a well diversified portfolio looks like.

To offer some further perspective courtesy of Doug Short, we can see that the quantum of student loans underwritten by the US Fed has risen 662% since the start of the last recession in Q4 of 2007.

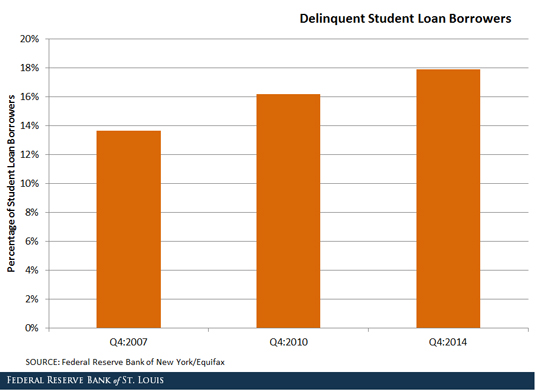

Meanwhile the most recent St Louis Fed study found that the percentage of student loan borrowers behind on their payments had risen to just under 18% as of the 4th quarter of 2014, as graphed below. As in the Greek debt debacle, excessive lending is a recipe for capital write-offs.