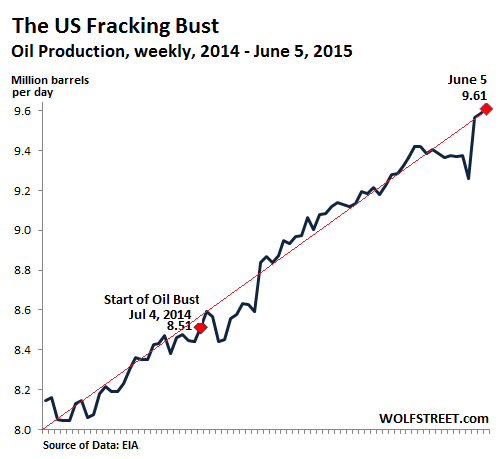

US oil production (along with global oil production) has continued to ramp over the past year as lower prices prompt over-levered players to pump more in order to grab the necessary life-blood of solvency–cash flow.

Their poker face seemed to convince some traders and hopefuls in March, that the bottom might be in for oil and energy company shares. Since April however, crude prices have flat-lined and energy shares (XEG Index below) have relapsed, suggesting that the cyclical rebound in the energy sector that led the North American economy out of the 2008 recession, is now behind us and more mean reversion (lower green band area) room lies ahead.