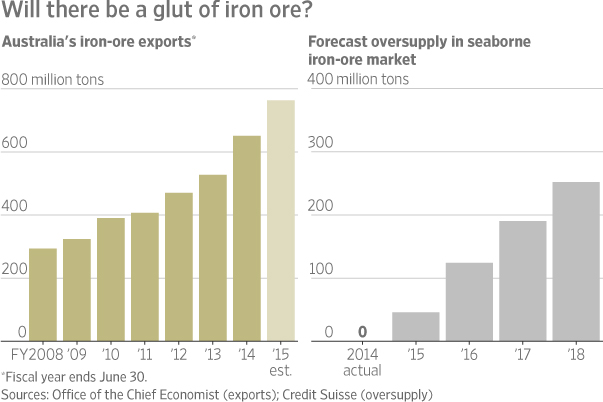

This morning oil is falling on news that an Iran deal will be worsening the supply glut as global demand (led by speculative implosions in China) heads even lower. The Canadian and Aussie dollars are back near their 52 week lows and levels first breached heading into the 2008 recession. But it’s much more than oil that is weak. Dr Copper is once more near January lows, other metals are swooning along for the ride. Iron ore is piling up like sand at the beach.

Commodity cycles have always been boom and then bust. There is nothing new in this. A consensus of raging bulls up to 2008-2011 assured the present collapse was baked in. This was entirely foreseeable for those who were willing to see. Unfortunately, most participants were too invested in the dream to be practical. As always, it is the irrational borrowing and lending that causes the years of carnage to follow. See, Debt load digs into mining industry:

Commodity cycles have always been boom and then bust. There is nothing new in this. A consensus of raging bulls up to 2008-2011 assured the present collapse was baked in. This was entirely foreseeable for those who were willing to see. Unfortunately, most participants were too invested in the dream to be practical. As always, it is the irrational borrowing and lending that causes the years of carnage to follow. See, Debt load digs into mining industry:

As forecasts predicting endless growth in China’s appetite for raw materials became a matter of industry faith, mining companies borrowed extensively to build networks of pits, railway lines and port terminals. Megadeals abounded as a merger-and-acquisition frenzy took hold. Cheap borrowing costs, thanks to low global interest rates, fueled the splurge.

Now, as China’s hunger for resources ebbs and mining companies’ profits suffer amid falling commodity prices, those debts have become an albatross around the industry’s neck. Amid a slump in Chinese share prices last week, metals such as copper and aluminum fell to near six-year lows. Iron ore at one point hit its weakest level for a decade.

“There’s been a colossal misjudgment of future demand,” said Dali Yang, professor of political science at the University of Chicago. “That long boom made it especially difficult for people to expect anything otherwise. Many bought the big story about urbanization, instead of thinking how things could go bad.”

The world’s largest mining companies by market value had accumulated nearly $200 billion in net debt by 2014, six times higher than a decade ago, according to consultancy EY, while their earnings only increased roughly two-and-a-half times. Large mining companies have written off roughly 90% of all the acquisitions they made since 2007, according to Citigroup Inc.

Even if top mining companies devoted all their earnings less investment spending to paying down debt, it would take up to a decade to clear the decks, according to a Wall Street Journal analysis of EY data.

Just as Germany will ultimately have to pay in write-downs for the excessive vendor financing it has offered over-indebted customer states the past decade, Canada too has some writing down and right-sizing now to do. The truth is we have earned an extended payback period. To dream otherwise is foolish.

As always, it is only those who use the boom period to pay down debt and sell assets that have cash, and lasting wealth left to show, from these cycles.