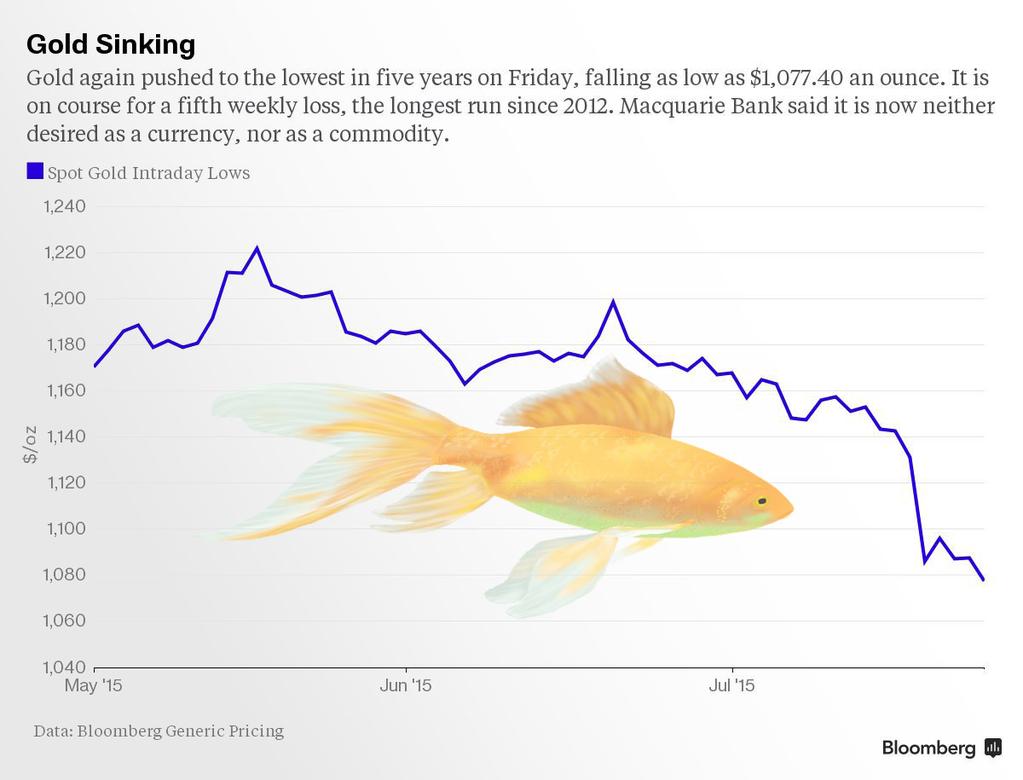

And so it goes: following the latest manic episode that began in 2001 and peaked in 2011, gold is now neither desired as a currency nor a commodity. See: Gold prices sink to a 5-year low.

“Investors are selling the metal from gold-backed funds at the fastest pace in four months. Holdings in exchange-traded products declined 17.6 metric tons this week to the lowest since 2009, data compiled by Bloomberg show.

Of course it’s not just gold that has disappointed precious metals fans:

Silver for immediate delivery lost 1.41 percent to $14.4684 an ounce after touching the lowest since 2009. It’s also set for a fifth weekly loss.

Palladium fell 0.8 percent to $613.55 an ounce, while platinum was down 0.7 percent at $971.53 an ounce”.

With the price of bullion now below the 1115 to 1135 trading range that had held since 2013 (blue box on right below), there is little holding gold from joining silver at 2009 lows. And if this is the typical end to the secular boom that was, a break below the 2009 cycle lows is also within reason, as mean reversion round trips previous secular boom gains.