The people who are passionate about gold (most of whom make their money selling gold and financial products based on it to others) are not going gently into the night of 40% declines to date. They remain bound and determined to sell us all on the promise of a big recovery coming any day now. Well, could be.

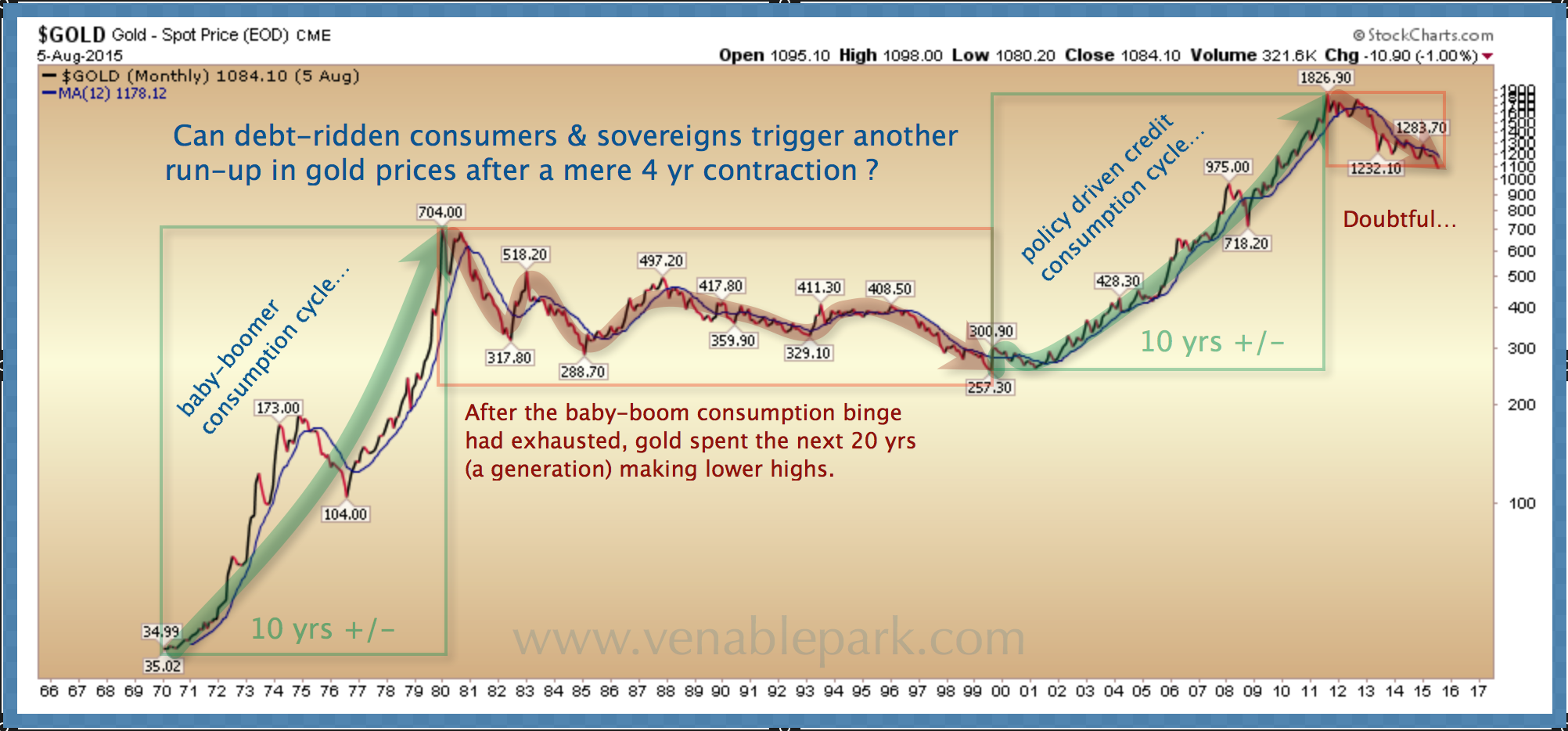

Or it could be that gold will spend many more years in a secular bear that began in 2011 and may drive prices back into the $300 to $500 range (red box in middle) where it labored for 20 years during the 1980 t0 2000 secular decline. That previous down cycle also followed a massive global leveraging decade from 1970 to 1980 (green box on left) as the boomers and the banks piled on consumer debt and gold rose with inflation.

The latest debt bonanza from 2001-2012 (green box on right) coincided with a similar boom in gold prices. Once we recognize though that the debt added in the most recent cycle has been many multiples more than during the 1970-1980 boom, we might also expect that the deflationary effects during the current pay back period may be deeper and even longer than the 1980-2000 period. If that is the case, then gold bulls and their products could be in for a grueling slog yet to come. It would also be a pretty typical end to yet another commodities mania bust up.

As shown below since 1985, oil may suffer a similar fate in the process. Not only does the commodity price face potentially years of deflationary pressures during this next global debt payback period, but it is also being battered by a relentless tsunami of innovations that are enabling the world to use less and less fossil fuels from here on out.