Late in every market cycle, financial gurus who are mandated to stay fully invested in equities at all times start talking about dividend paying stocks being ‘defensive” picks in ‘corrections’. If only that were true.

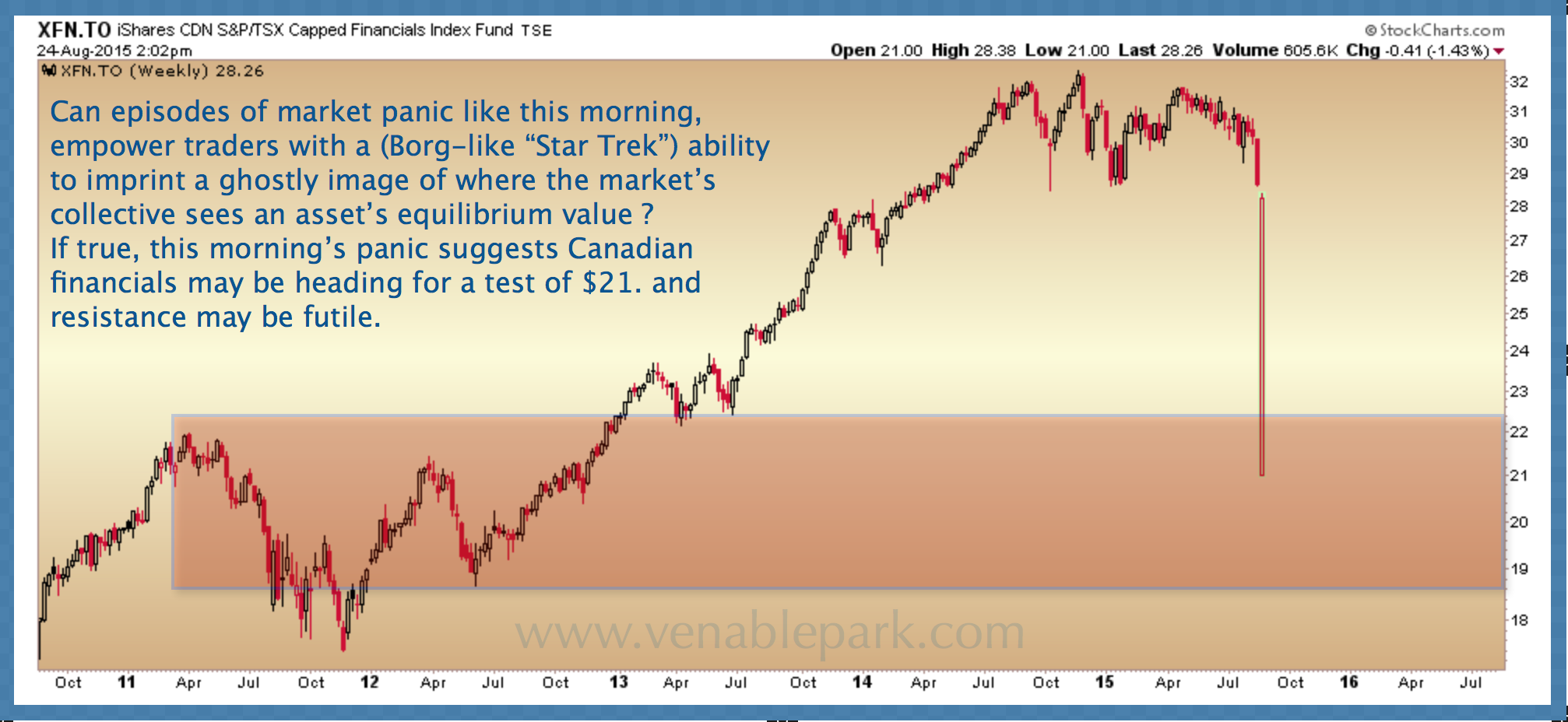

This chart of the Canadian financial Index (XFN) is just one poignant example. From a high just under $33 last November when all the usual suspects were saying their usual “we love the banks in here”, the financial index dumped 36% to trade at $21 a share this morning, before quickly rebounding back to the $28.00 range this afternoon (still down 14% from last November). Lest some think this an irrelevant blip, sudden crashes in heinously over-valued, highly levered markets tend to be foreshadowing of more lasting mean-reversion moves to come. Dividends will be insufficient salve for such deep capital wounds, as years of expected income are outweighed by principal losses.

Today while trusting clients go about their daily lives, few will have noticed the warning shot marked out this morning by many of the most trusted ‘blue chip’ shares. It will not be until prices start closing at fresh lows on monthly statements that most will be aware of the damage done to their savings.