As oil flops around near its 2009 recession lows (brown box below), the Canadian dollar has already said “Canada’s worse this time” with a decisive break to a lower low at the end of August (red circle below) and in September still falling, today within a hair of its recent 52 week low. And indeed compared with Canada’s standing among other OECD countries before the 2008 recession, the economy is in fact worse today on several key metrics. See a few here: Canada’s economic slide (since 2006) in 5 charts.

Most importantly, the commodity supercycle that ran from 2001 to 2008 is now over, and that makes Canada’s financial prospects worse than at any time in the last 15 years.

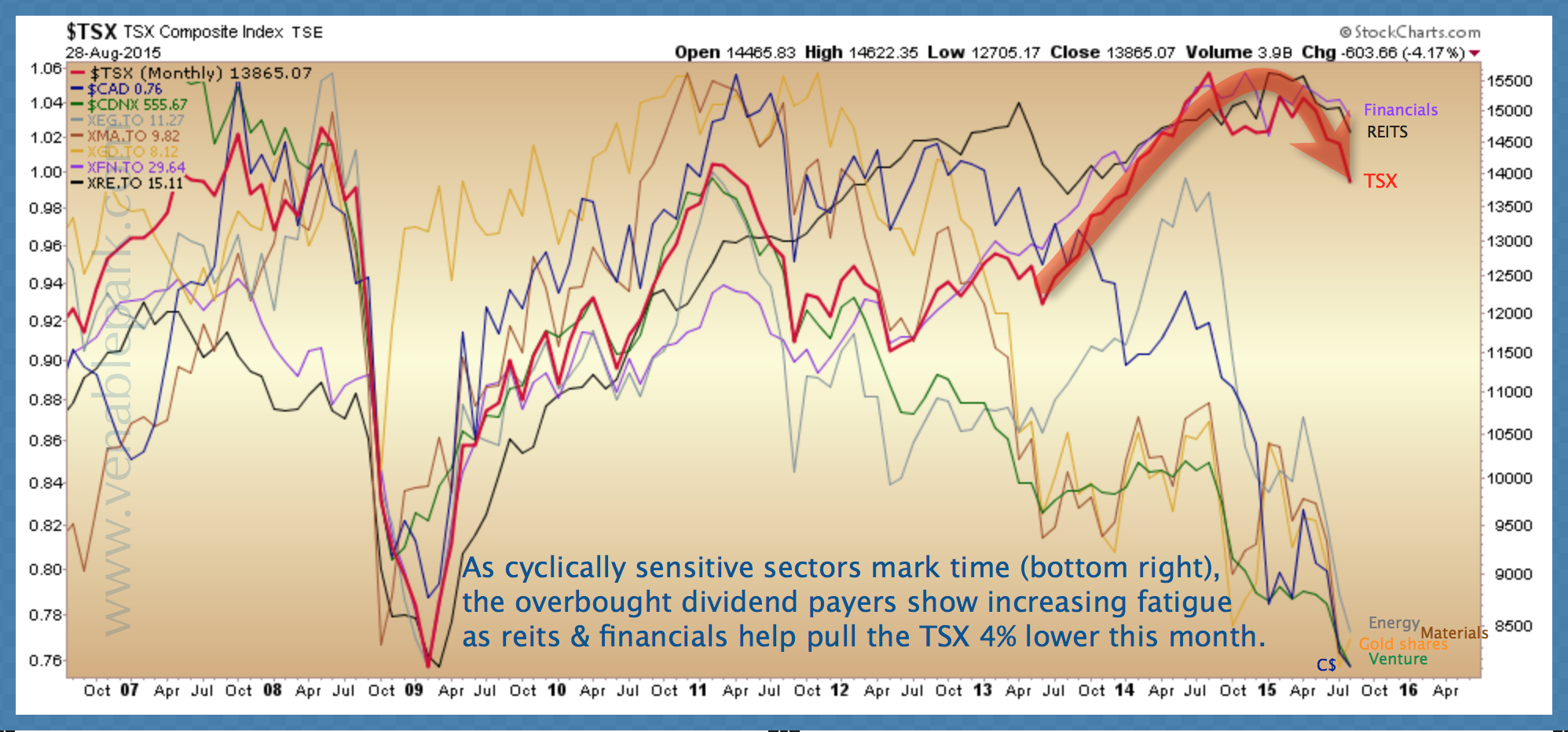

Revenue is falling and not likely to bounce back soon, just as Canadian households are the most indebted they have ever been and realty prices some of the most over-valued in the world. All of this underlines the glaring price risk apparent in Canadian REIT (below in navy) and financial shares (purple) as well as the broader TSX (in red) which today remains perilously dependent upon these last two now rightsizing sectors.

On the upside, for those who can see the big picture and minimize downside exposure today, a future of investment opportunity at much lower prices ahead looks bright. With Canada’s financial strength much worse this time, and the resource-centric Venture exchange (in green above) and the Canadian dollar (in blue) already acknowledging this with a move below their 2009 cycle lows, the obvious question is, does a similar acknowledgement now await the broader market, financials and REITs?

For those with cash, patience and discipline today, the odds have very rarely been as good.