With plunging commodities and evaporating underwriting, to rising defaults in debt-laden households and top-heavy realty markets, Canadian financials have come into a rough patch. And they have earned it. In a cruel twist of Bank of Nova Scotia’s hideous slogan: Canadians are starting to discover that they are “Poorer than they thought”. See: Half-empty office buildings on the rise in Calgary, Edmonton and Cracks begin to appear in Canadian bank earnings.

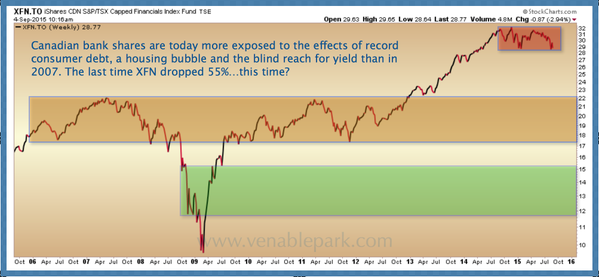

The question is how much do Canadian financial shares have to give back in order to pay penance for their most recent era of reckless excess. As shown in this chart of the sector (XFN) since 2005, the potential downside this time should give sober capital cause for pause. Having fallen just over 10% since April–evaporating 3 years of dividend income in 4 months–the sector would need to lose a further 45% just to retrace QE-mania over-pricing since 2010. That would make for a total decline of 55% since the April 2015 peak and be perfectly in line with the loss cycles seen in both the 2001 and 2008 meltdowns. But would that be enough this time?

With leverage in the Canadian banking and realty sectors higher today than at any time in the past 20 years, and with Canada now at the end rather than the start of a commodity supercycle, this time finance shares could have even further to mean revert (possibly the green band marked above).

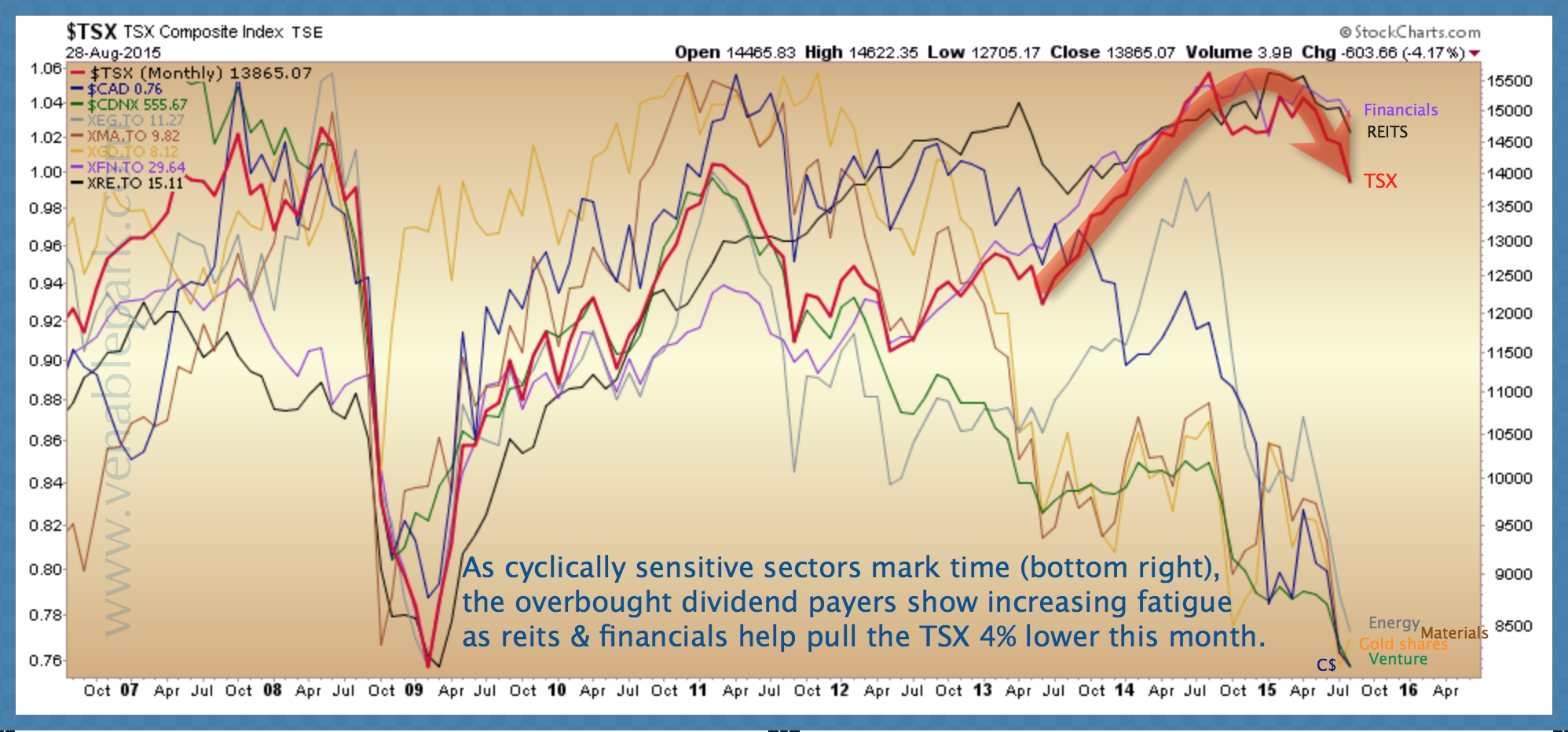

Holders and indexers of the broader market TSX–that is presently some 36% weighted in financials–should also have their eyes wide open.