Better late than never? This morning Goldman Sachs finally capitulated on oil prices…

The global surplus of oil is even bigger than Goldman Sachs Group Inc. thought and that could drive prices as low as $20 a barrel. Here is a direct video link.

There is no question that lower prices are better for cash strapped consumers. The trouble is that lower prices are also hugely negative for a large part of the global economy (households, companies and countries) which has been heavily dependent and over-spending on the presumption of continued high oil prices. Central banks have exasperated global imbalances with their repeated asset stimulus programs over the past 15 years which kept many commodity prices higher for longer than natural market forces would have allowed. This led to massive mal-investment and levered financial speculation over the past decade which is now unwinding.

After the US consumer bubble burst in 2008, prices should have been able to clear and find a natural supply/demand equilibrium once more. But the QE-funded rebound 2010-2014 intervened to extend distorted pricing for another 4 years. In the process, many participants and countries were enticed to a highly levered demise. Brazil will not be the last emerging country to be downgraded to ‘junk’ status. See: Other big EM names in crosshairs after Brazil downgrade.

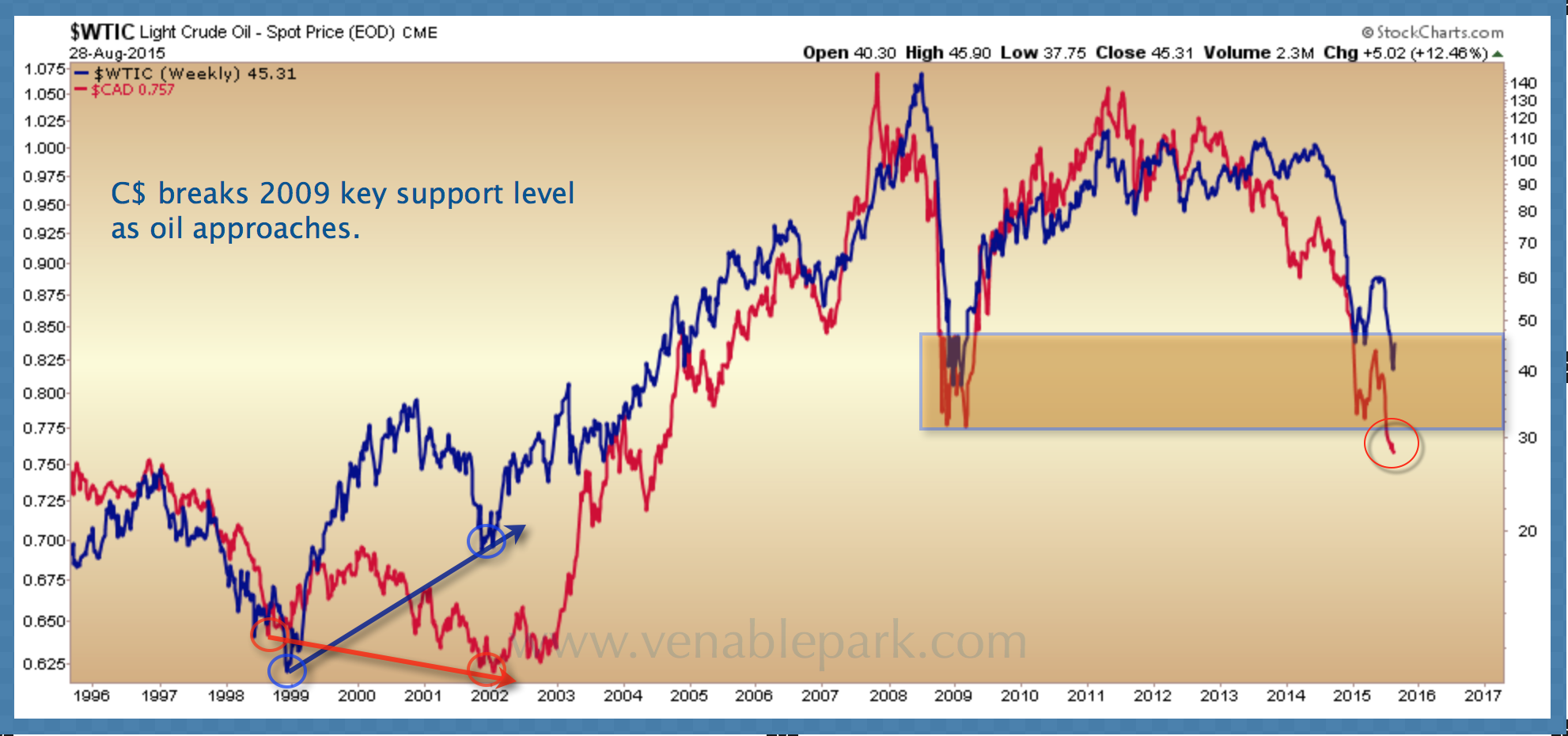

Far from a big, bold call, $20-$40 oil has long been the likely area of mean reversion at the end of this epic credit cycle. My technician partner Cory Venable, has been highlighting this level for years (in charts like the following), while the mongrel hoard continued extrapolating the sky-as-the-limit.