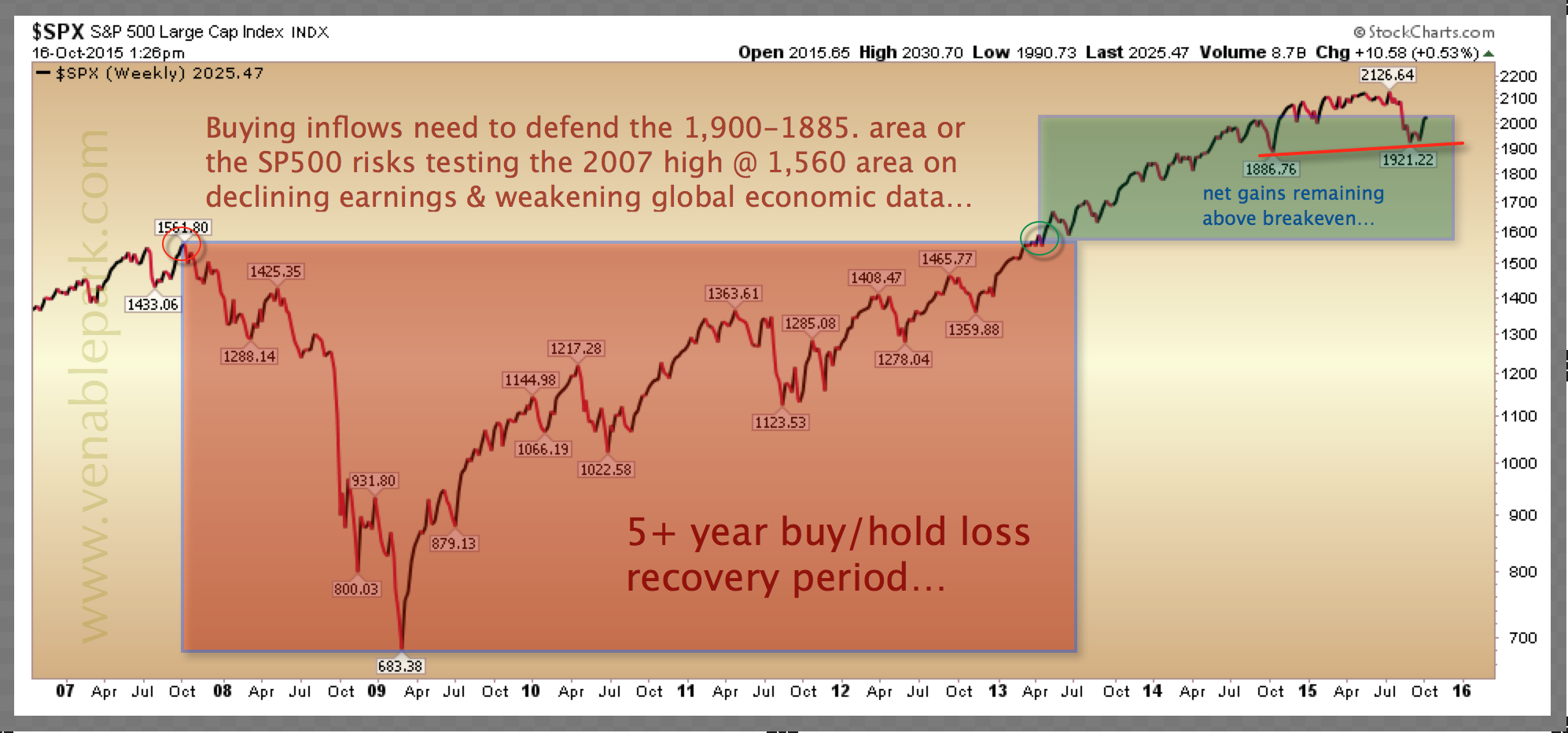

The finance business reaps profits by selling us risk. When valuations are cheap we have a better than average probability of earning reasonable compensation for that risk. When valuations are high, we don’t. In fact when valuations are near secular, multi-year highs, holders have a high probability of losing money for their trouble. The chart below of the S&P 500 price performance since 2006 underlines this point.

After becoming highly overbought and overvalued 2005- 2007 (achieving the then third richest valuations in history behind 2000 and 1929), the S&P crashed 55% and spent the next 5 years trying to make back losses (red box). It took relentless pushing, prodding and trickery by policymakers and risk-sellers alike before US stocks finally made fresh highs in the second half of 2013 (green band above). In the process, investors have been shaken and inadequately compensated. And it gets worse.

The two years of gains 2013-15, have now set holders up for a high probability of yet another round of capital losses from here, followed by even more years trying to recover principle. The majority will not be able to hold on. And even if they do, flat to negative returns won’t pay them for the trouble.

Canadian investors have fared even worse. As shown below since late 2006, the broad Canadian TSX briefly reclaimed its 2008 peak for a few intermittent weeks in 2014 (marked in green) before falling back into the red in 2015.

A counter-trend rally the past two weeks, just brings the TSX to levels first reached in 2007–amounting to 8 long years of reward-free risk.

What’s more, the probability of capital loss in Canadian stocks today is also back at cycle highs similar to that of September 2000 and June 2008, where the broad market went on both times to lose 50%+ thereafter (even without a Canadian recession in 2001).

Those banking on rewarding equity returns for capital today have a problem: they have next to no chance of getting there from here. With a secular bear in motion since 2000, and stock valuations back at cycle highs: the next big loss cycle would be just desserts.