As the Organization for Economic Cooperation and Development (OECD) downgraded global growth forecasts for the second time in three months, to 2.9% in 2015 and 3.3% in 2016, the cumulative cost of relentless central bank ‘stimulants’ since 2008 continues.

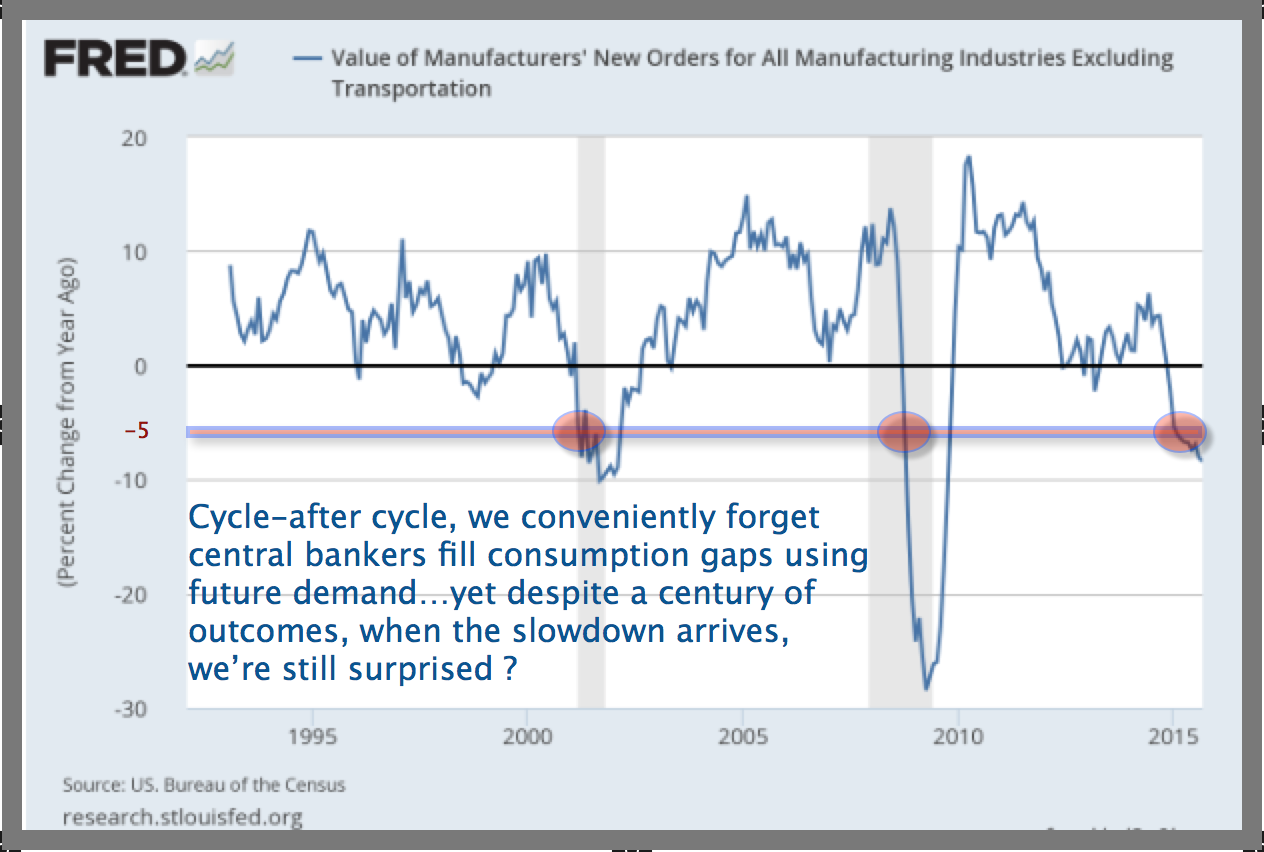

The trend of US New Orders since 1990 (below) reminds us that central banks never create demand. Each cycle they have only loosened rates in order to borrow demand from the future. Now the future has arrived more indebted than ever before and consumption is running on fumes once more. This time, we enter the downturn on monetary empty.