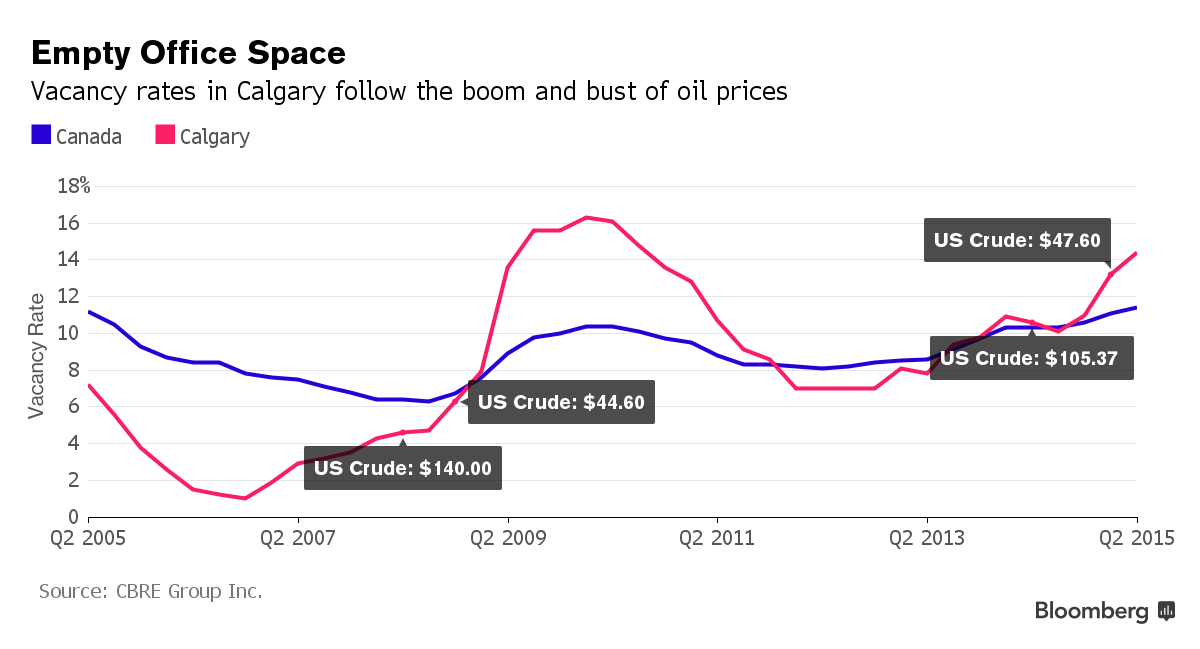

The vacancy rate in downtown Calgary jumped to 14% in Q3 (not including some 2 million square feet of so-called “shadow vacancy” or space leased but sitting empty, which if counted would push the vacancy rate to 16%, the most since the 1980s downturn. See: Empty floors, shadow vacancies, new norm for Calgary tower owners.

Office-tower owners in Canada’s energy hub are about to feel the full force of the oil-price crash.

Vacancy is already at a five-year high in Calgary and rents are the lowest since 2006 after thousands of office jobs were cut. Energy company tenants have now begun to ask for rental relief and are offering subleases for as little as half the going rate, according to real estate brokers including Jones Lang LaSalle Inc. and Avison Young Canada Inc.

That’s before five new office towers with about 3.8 million square feet (353,031 square meters) of space hits the market in the next three years.

“It is a bloodbath,” said Alexi Olcheski, an office-leasing principal at Avison Young from his office in downtown Calgary. “We’re at the highest point of fear and uncertainty now.”

Although Calgary and Alberta broadly are the epicenter of this latest oil led-downturn, they are not islands. Toronto, Montreal and Vancouver office space are also due for downsizing after years of expanding accounting, legal and finance firms during the oil and commodities boom 2002-2008(11). And then there are the many REITS which not only have exposure to falling rents and vacancy rates in office space, but also in the consumer retail sector now garishly overbuilt in Canada (the nation with the distinction of having the highest household debt levels in the G7 today). Previous favorites–REITS and finance shares–have now started what should be a major cyclical correction. They’ve earned it.

Although Calgary and Alberta broadly are the epicenter of this latest oil led-downturn, they are not islands. Toronto, Montreal and Vancouver office space are also due for downsizing after years of expanding accounting, legal and finance firms during the oil and commodities boom 2002-2008(11). And then there are the many REITS which not only have exposure to falling rents and vacancy rates in office space, but also in the consumer retail sector now garishly overbuilt in Canada (the nation with the distinction of having the highest household debt levels in the G7 today). Previous favorites–REITS and finance shares–have now started what should be a major cyclical correction. They’ve earned it.

Caught in the downturn are tower owners including Dream Office REIT, Artis REIT and Morguard Corp., whose shares have dropped about 27 percent, 14 percent and 5.1 percent respectively over the past 12 months. The Standard & Poor’s/TSX Capped REIT Index is down 8.7 percent over the same period compared with a 8.2 percent drop in the broad S&P/TSX Composite Index. U.S. crude has dropped more than half since its peak in June 2014 to hover around $45 a barrel.