As the commodity drubbing continues today, the Canadian dollar index has made a fresh 52 week low and is now at levels not seen since 2003-05.

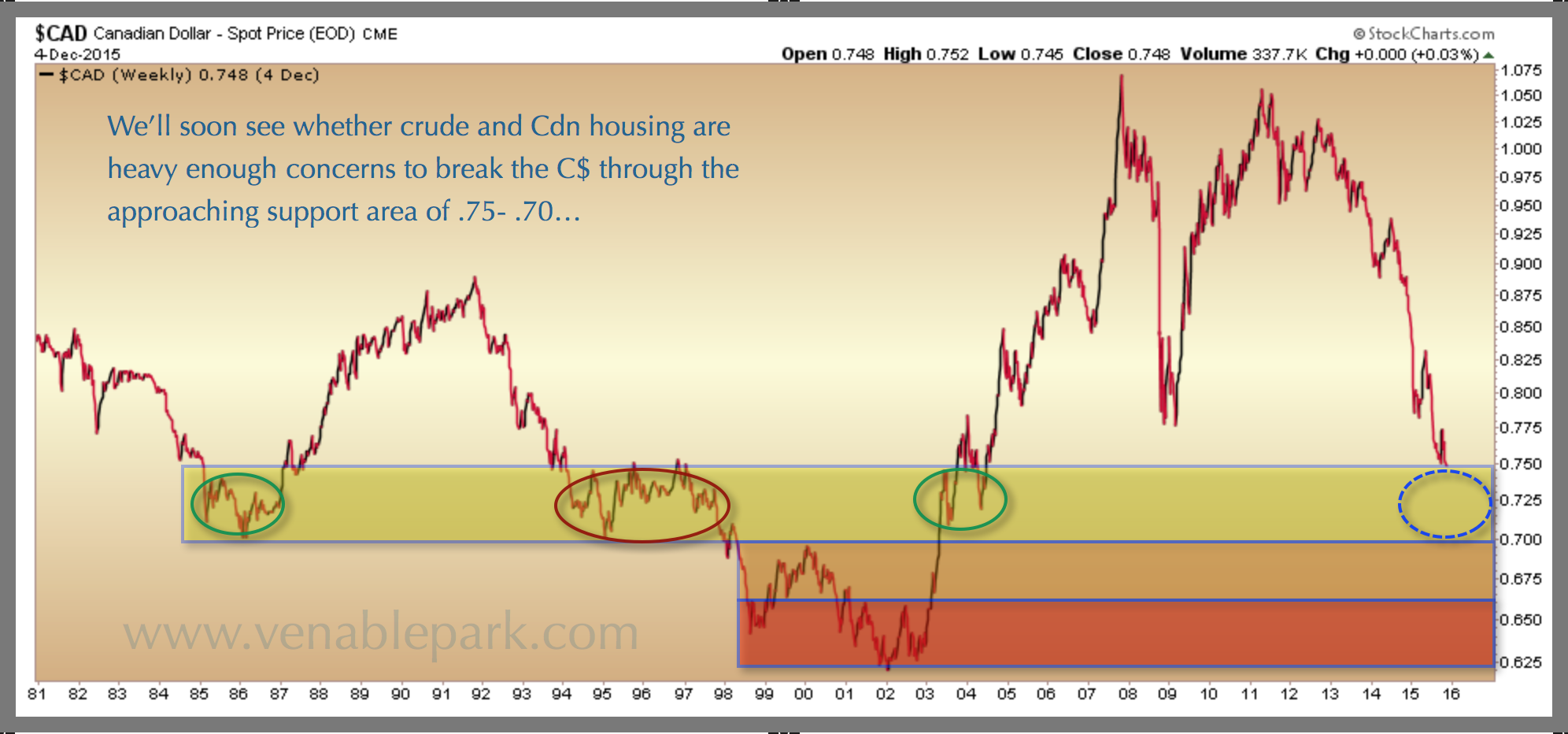

The chart here since 1981 offers a helpful long-term view. Closing below .75 last Friday, and below .74 today, the new test band is the .70-.75 range where the loonie bottomed in prior cycles (see yellow box below).

However, now at the end of the late great commodity super cycle of 2001-11, and with the price of crude still falling and Canada’s housing and household credit bubble yet to deflate, a return into the red zone where the loonie submerged 1998-2003 cannot be ruled out.