With Western Canadian crude trading in the mid-20’s this morning, the Canadian dollar and economy are continuing to weaken on vaporized revenues over the past year. The broad stock market has ‘given’ the technically significant 13000 level (see lower beige band at point 6 below) as highlighted in my partner Cory Venable’s chart from the end of November.

And it is not just oil and commodity companies that are plunging, financials and dividend paying blue chips are also down over 3% on the week so far; REITS are down over 2%. It is important to remember that these last three ‘defensive’ sectors have been the final leg propping up the Canadian stock market over the past couple of years while real economy sectors retraced to their 2009 bear market lows (marked with purple arrow next chart).

Once the ‘defensives’ break, belief in the bear market goes mainstream and there is little to stop the broad market from also retesting its prior cycle lows. A return to the 2009 bottom would be entirely consistent in the secular bear environment that has been dominating equity markets since late 1999.

Meanwhile it is critical to understand that mutual funds and traditional money managers are always talking in terms of ‘relative’ rather than absolute performance. They are mandated by their constating documents to remain near fully invested in equities at all points in the market cycle. Holding stocks that drop less than the overall market, is what they consider to be ‘out-performance’. In real life losing 45% rather than 55% of one’s savings, is no meaningful benefit for clients. But the money business lives in a dream world of its own marketing.

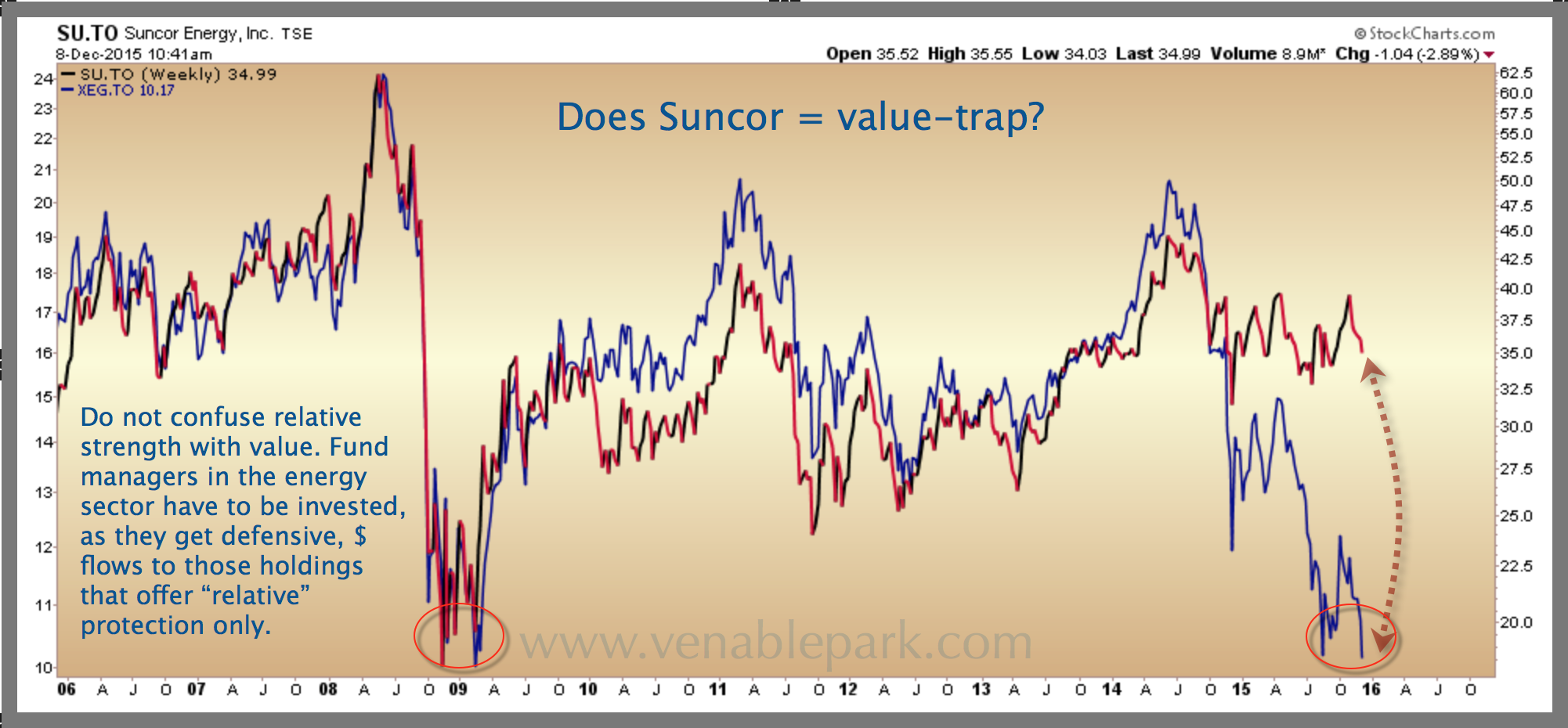

The next chart of Suncor versus the energy sector index (XEG) offers some perspective. As a mature, dominant company in the space, Suncor is considered a ‘blue chip, dividend paying, defensive’ core holding for most portfolio managers.

But as shown above since 2006, the fact is that Suncor shares tend to lag, but not decouple broad market downturns. As more junior companies fall, captive, long-always capital rotates out of them and into larger names. This later cycle buying pressure levitates the majors for a while in relative ‘out-performance’. But when the retail crowd and levered speculators finally panic in mass, the selling waves hit everything at once.

The same buyers that were price indiscriminate as valuations became extreme during the up cycle become just as indiscriminate in their selling during the down cycle. This is how remarkable opportunity finally presents for patient capital. But only for those who are wise enough to protect and prepare in advance.