For pity sake, please do not buy $700,000 homes with 45K down and 655K mortgages, even if your mortgage/financial adviser, specialist, architect, sales person says that you qualify. Please run away…If you don’t have a healthy down payment to use, it means that you are buying something you cannot actually afford and are taking on grave life risk to do so.

The federal government introduces some changes to down payment requirements for federally regulated lenders. This video breaks down the “old” rules versus the “new” rules. Here is a direct video link.

(put your head in the vice here…)

There is a reason the ‘good old days’ required people to save 20% and more before they tried to buy a house. It’s called financial stability.

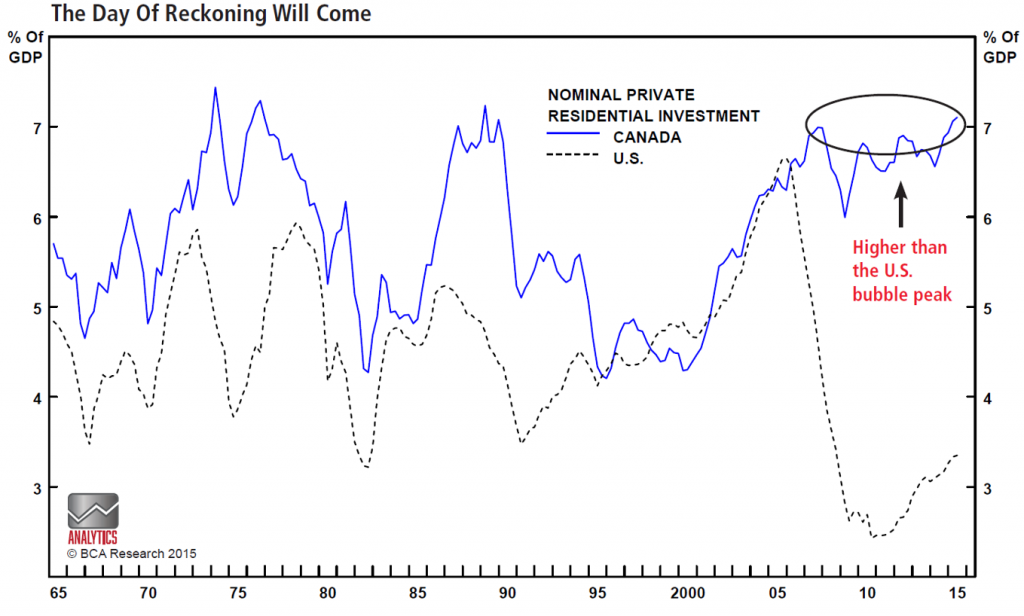

This recent chart courtesy of McLean’s Magazine offers some useful perspective on how all this buying homes with record amounts of debt has enabled excessive pricing and mal-investment in the Canadian realty market (in blue) since 2005.

No other country in the world has ever been able to hold extremely valued home prices at a permanently high plateau indefinitely, especially while real income levels have stagnated and are now crashing lower with the oil sector. Time to be defensive not insanely levered. As for ‘we’ taxpayers, who have underwritten the bulk of this reckless borrowing through government back mortgage insurance…not likely to end well for us either.