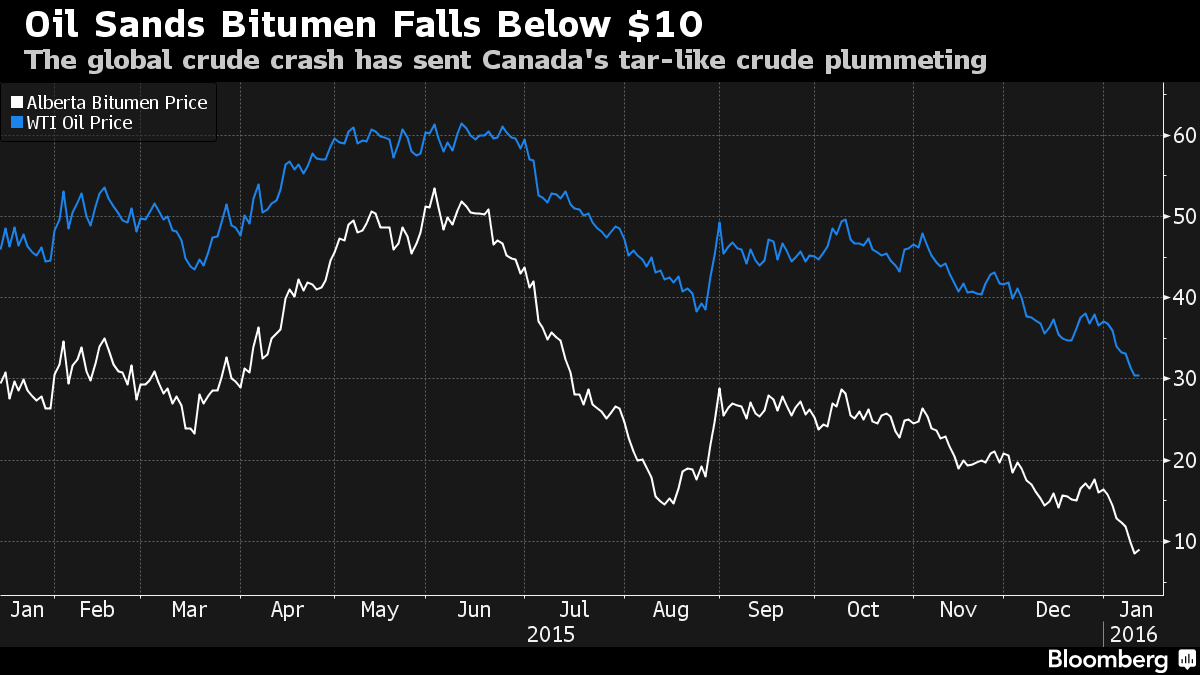

Hitting a low of $8.35 a barrel yesterday (down from $80 2 years ago), Canadian oil producers are losing money at current prices. Yet so far, they are continuing to pump at record levels nonetheless. The spending to extract bitumen is front-loaded and so sunk costs encourage producers to increase output as prices fall. Today highly indebted and desperate for cash flow, most don’t see a choice. See: Crude at $10 already a reality

Already down 80% in a world still reliant on oil, price risk now is a fraction of its former self. Rational thinkers know, the black stuff isn’t worth zero.

But near-term, large downside pressures remain: the world is running out of places to store the present glut and an unraveling of the distressed OPEC cartel would increase the “every producer for itself” thinking that could surge global production and pummel prices further.

The oil price bubble of 2005-14 has burst in spectacular fashion, as all bubbles do…but incredibly, this price plunge may still have further room to run.