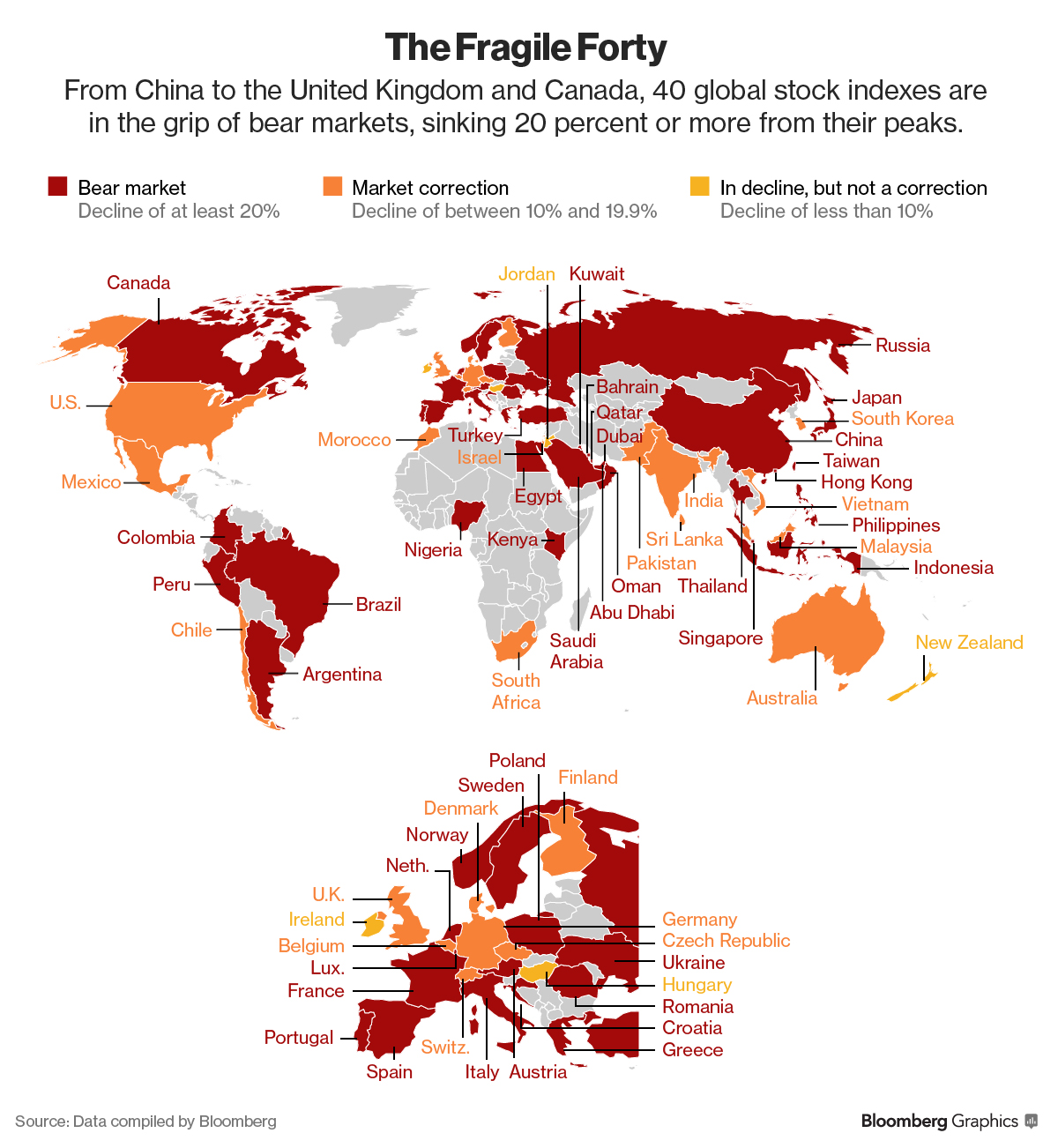

Having evaporated more than $16 trillion off global equity markets in the past 6 months, 40 countries have already entered bear markets, down more than 20% to date. The trouble is that during secular bear environments where the cyclical declines start from high leverage and extreme valuations (as in 1929, 1965, 2000, 2007 and 2014), the losses tend to average 40%+ before the selling exhausts. While interim rallies are to be expected, the impetus to sell into strength persists.

Billionaire investor George Soros said China’s economy is headed for a hard landing, a slump that will worsen global deflationary pressures, drag down stocks and boost U.S. government bonds.

“A hard landing is practically unavoidable,” he said in an interview with Bloomberg Television’s Francine Lacqua from the World Economic Forum in Davos on Thursday. “I’m not expecting it, I’m observing it.” Here is a direct video link.

See: Global shareholders have $27 trillion locked in bear markets.