Some refreshing candor out of the guest in this clip. Even as the Bloomberg-tainers keep trying to pump sexy and sophisticated ‘plays’, Carnutt doesn’t relent: central bank intervention has broken financial markets, to protect savings one needs to ‘de-risk’ ie., sell risky assets and products…and more central bank tricks from here will further compound problems and risk, not help.

Dean Curnutt, chief executive officer at Macro Risk Advisors, discusses volatility created by central banks and strategies for taking volatility out of your portfolio. Here is a direct video link.

And as my partner Cory Venable reminded yesterday, although the media circus focuses on oil, it’s actually all industrial commodities that are screaming ‘global slowdown’.

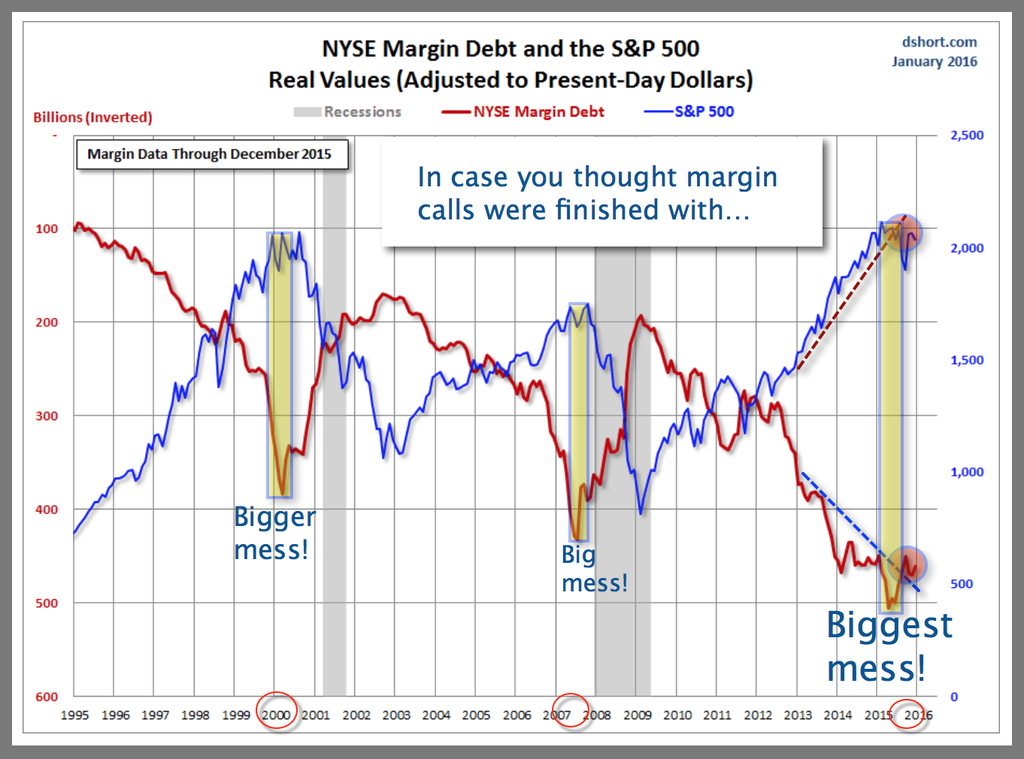

Meanwhile after blowing out to record levels into 2015, margin levels (levered bets in red shown below in inverse scale) have finally rolled over in the past year leaving a glaring chasm under the precariously inflated S&P 500 (in blue). Before this cycle completes, these two lines will change places–as they did in 2000-02 and 2007-09. Imagine that.