Yesterday on day 3 of another sharp rally, my partner Cory Venable observed that short-covering might push the S&P to near term resistance in the 1925 area (mid dotted line below). Today, that seems to be holding (so far at least). We should remember that short, violent rallies that fail and fall to lower lows, are actually a hallmark of bear, not bull, markets.

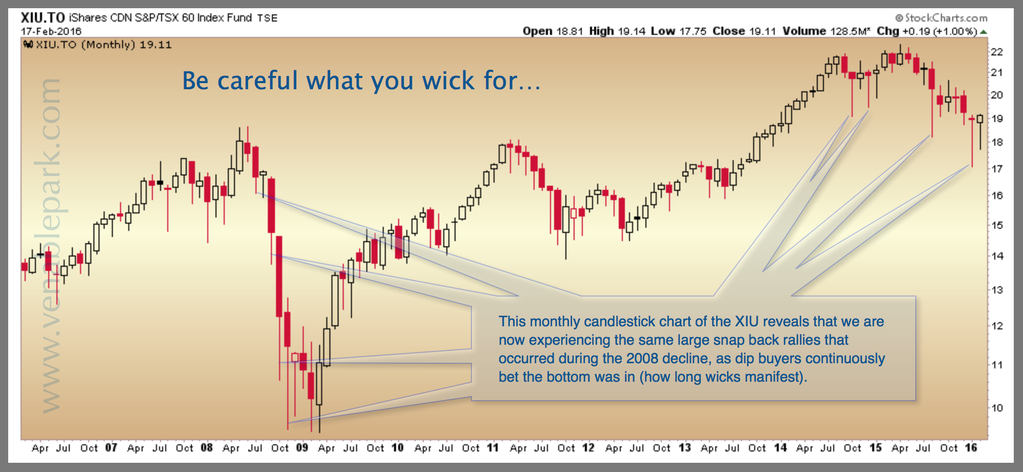

Today he added the following long term candlestick study of the Canadian TSX 60 ETF (XIU) since 2006 and points out that it too is exhibiting the lower highs and lower lows action consistent with bear markets. Take care of your capital.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In