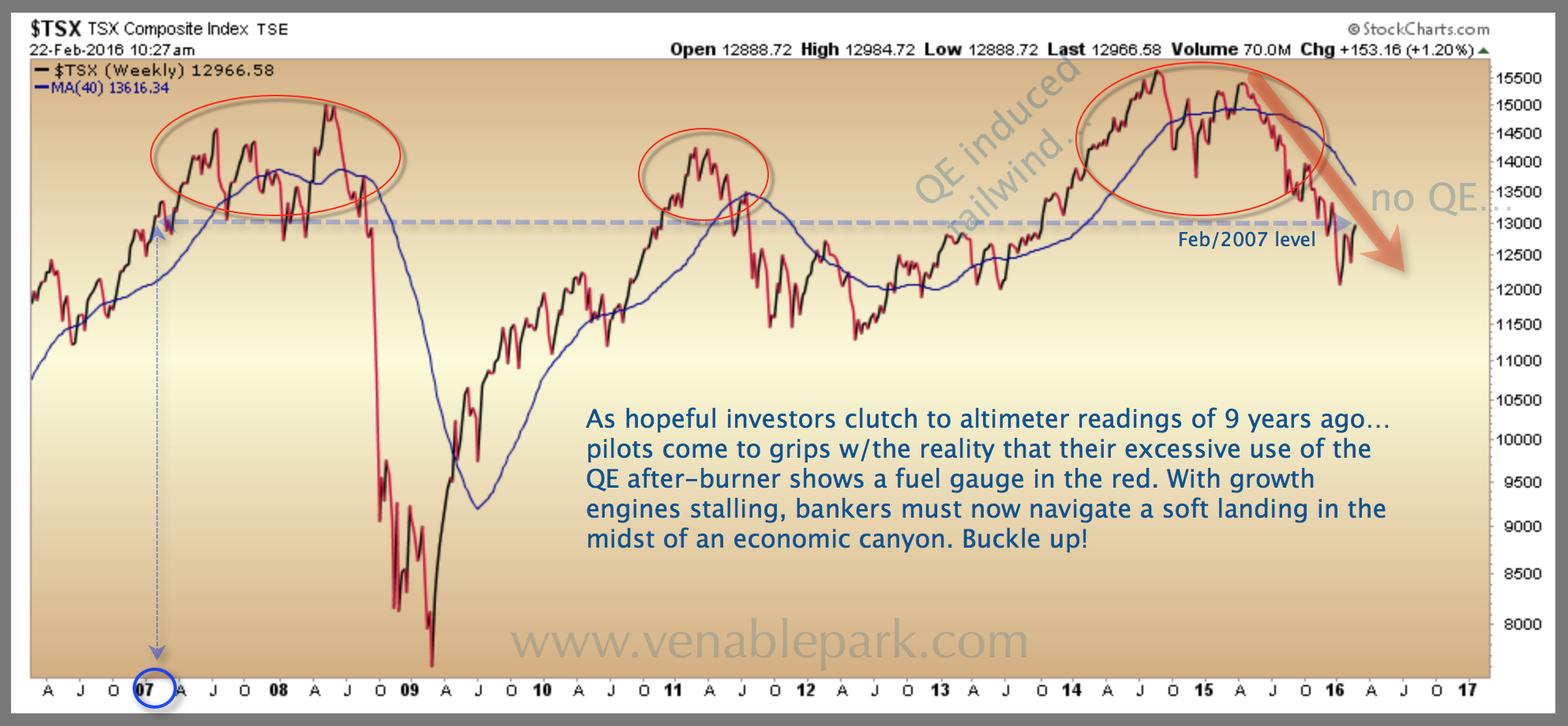

Some sharp rebound rallies notwithstanding, Canada’s TSX composite (shown below since 2006) has been in a downtrend since the 2nd quarter of 2014 and is today back to the same level first reached in February 2007. (capital progress?)

The first phase of the decline was lead by 70%+ losses in the materials and energy sectors. But now commodity based pain is spreading to the many feeder sectors: retail and service industries (like realty) and financiers.

Down just over 16% to date, the Canadian stock market (TSX) remains vulnerable, with a retest of the March 2009 lows within the realm of secular probability. Buy and holders beware.