After all the usual suspects at central banks failed to hike rates at recent meetings, risk markets in North America are bouncing today. (Treasury yields are not so far agreeing with the inflation hopes of stocks, and are moving lower.) Apparently inaction is the new easing? Except in truth, inaction is not easing, and with everyone hoping to weaken their currency to boost sales, no one is likely to gain traction.

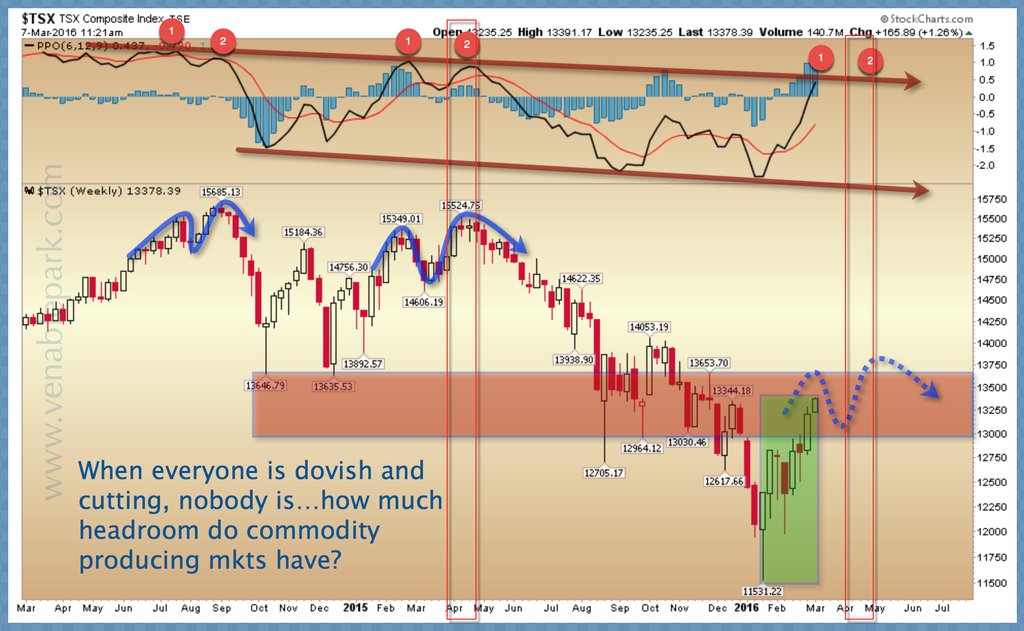

The Canadian TSX has rebounded back into the resistance box which was marked on March 7 below, as oil has bounced on talk of talks about the potential for maybe some agreement on a production ‘freeze’ at record levels from OPEC next month? Maybe? Not likely. But even if there were an agreement, the members have a bad history of cheating, and cash flow desperate people have a tendency to do just that. Then there is the little issue of the existing record global inventories and weakening demand…