For anyone wondering why so many working Americans are disenfranchised and disenchanted today, a review of some numbers sheds light. A 2010 report from the U.S. Commerce Department defined ‘middle class’ in America as including homeownership, a car for each adult, health security, a college education for each child, retirement security, and a family vacation each year.

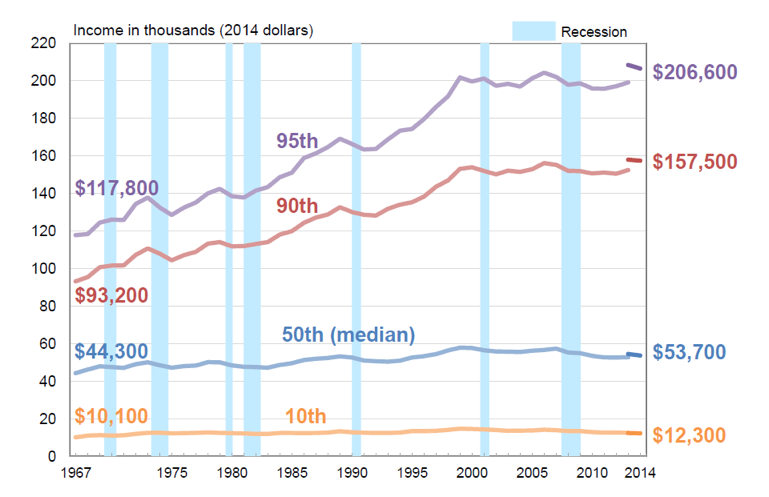

2014 analysis by USA Today concluded that for a family of 4 to attain the Commerce Department’s middle-class benchmarks it would require an income of just over $130,000/year. The trouble is that the median family income in 2014 was less than half that amount at just over $53,700 as shown in this US Census Bureau chart.

As incomes have stagnated for the majority over the past few decades, keeping up middle class appearances has banished savings and prompted the accumulation of crippling debt, while most families strive to keep their struggles hidden, even from their children. A writer for The Atlantic in the May issue dares to break the silence and admit truth about his plight: “In the 1950s and ’60s, American economic growth democratized prosperity. In the 2010s, we have managed to democratize financial insecurity.”

As incomes have stagnated for the majority over the past few decades, keeping up middle class appearances has banished savings and prompted the accumulation of crippling debt, while most families strive to keep their struggles hidden, even from their children. A writer for The Atlantic in the May issue dares to break the silence and admit truth about his plight: “In the 1950s and ’60s, American economic growth democratized prosperity. In the 2010s, we have managed to democratize financial insecurity.”

The first steps to recovery are admit and repent, so people ‘coming out’ and admitting the truth to each other on this is productive. The repent part requires lifestyle changes, downsizing of expenses and admitting that many things are actually unaffordable. Our add more debt and stir era is coming to a close. Until real wages can move higher and debt levels move significantly lower, consumption will have to continue contracting in America and most of the world. The Atlantic article is worth a read. See: The secret shame of middle-class Americans:

Many of us, it turns out, are living in a more or less continual state of financial peril. So if you really want to know why there is such deep economic discontent in America today, even when many indicators say the country is heading in the right direction, ask a member of that 47 percent. Ask me.

Financial impotence goes by other names: financial fragility, financial insecurity, financial distress. But whatever you call it, the evidence strongly indicates that either a sizable minority or a slim majority of Americans are on thin ice financially. How thin? A 2014 Bankrate survey, echoing the Fed’s data, found that only 38 percent of Americans would cover a $1,000 emergency-room visit or $500 car repair with money they’d saved. Two reports published last year by the Pew Charitable Trusts found, respectively, that 55 percent of households didn’t have enough liquid savings to replace a month’s worth of lost income, and that of the 56 percent of people who said they’d worried about their finances in the previous year, 71 percent were concerned about having enough money to cover everyday expenses.