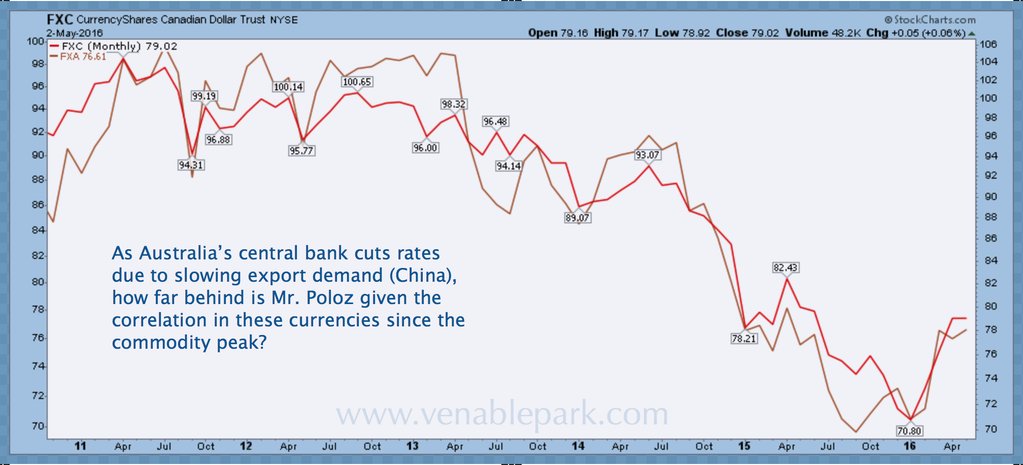

Commodities and commodity-centric currencies like the Aussie and Canadian dollar rebounded sharply as the US dollar Index weakened since February.

The trouble is that the debt-sickened global economy has stalled further in 2016, and so commodity use has being falling as prices rise and cash-strapped producers have even more incentive to pump product onto a world of excess inventories. Not a rosy demand picture. Six years of dumb, desperate central bank policies, have made matters worse.

This morning the Reserve Bank of Australia responded to falling growth and disinflation by cutting interest rates to a record low. The Aussie dollar is down 2% and the Loonie over 1% in early trade so far. The Japanese Yen meanwhile hit a new 52 week high this morning against the US dollar, in a vote that the Bank of Japan is out of options in its quest to force borrowing and weaken the Yen with negative rates. Dumb and dumber. Japan’s Nikkei is floundering, down 17% over the past 12 months. Meanwhile England and China both ‘shocked’ with weak growth reports this morning.

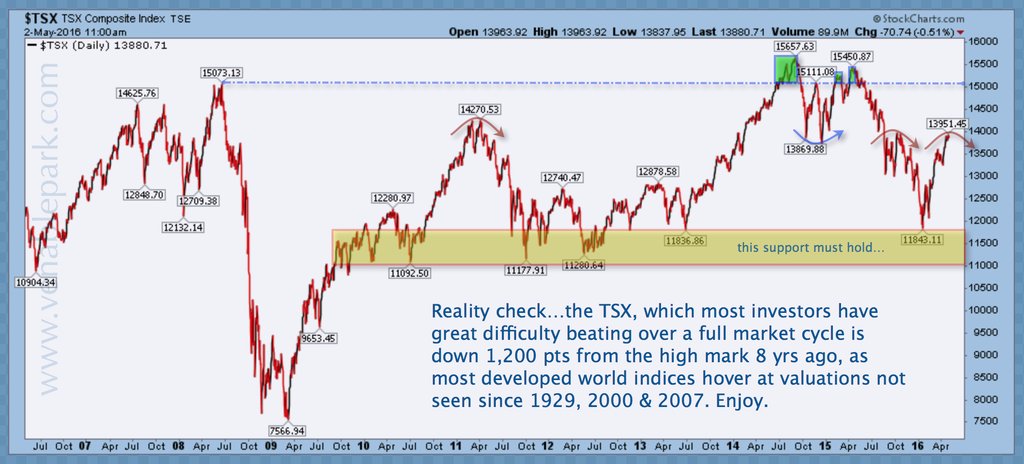

Canada’s TSX is taking all this reality especially hard today, and it should. The commodities demand boom is over and Canada is in a rough patch to say the least. The nation has more household and corporate debt than ever, as revenues contract. Well prepared, we are not. As shown in this chart of the TSX since 2006, 8 years after the commodity boom peaked, the Canadian stock market remains well below the June 2008 blow off top.

The speculative rebound in stocks since February has done no favors, unless to those who took the opportunity to raise more cash. For those looking for investment value however, there is little yet to found, as North American markets boast the most hideously inflated valuations since 2000 and 1929. Pretty perilous company to keep.

Someday soon, it will be obvious to the masses once more, that extreme asset valuations amid a secular downshift in revenues are counter-productive and only make downside risks worse. Those who have been holding and hoping with risk assets may think they have made some durable progress over the past couple of months. But that is unlikely.

What is highly likely is that this unprecedented era of central bank madness has built the backdrop for spectacular investment opportunities ahead, as mean reversion reasserts and cash proves king.