As the ‘vampire squid’ investment banking sector is slowly corralled and forced back under the rule of law once more, its revenues continue to retreat.

Long hailed as ‘the best of the best’ at institutional robbery, market manipulation and abuse of its customers, Goldman today announced that its overall revenues declined 13% in the second quarter while management slashed staff and expenses and reversed previous provisions for legal costs in order to goose earnings. See Goldman details cost-savings plan after ‘challenging’ quarter:

Goldman Sachs Group Inc (NYSE: GS) reported a higher second-quarter profit on Tuesday, as it benefited from a sharp decline in expenses and more activity in some parts of the fixed-income markets, but most of its businesses came under pressure.

In response to a “challenging backdrop” for revenue, the Wall Street bank embarked on a cost-cutting plan in the first half of the year that will save $700 million a year, Chief Financial Officer Harvey Schwartz said on a conference call…

But overall revenue declined 13 percent as all of its other businesses reported weaker results. Goldman’s profit was buoyed by cost cuts and the fact that it had a large legal provision in the second quarter of 2015

I venture a forecast: as the firm is increasingly not allowed to call all the shots and queer all the rules and markets to its own ends at the expense of the public purse, management will seek to shed the firms ‘too big to fail’ systemically important institution status (as GE recently did) and go back to being a pure securities underwriting and sales firm. Goldman will look to take its ball and go home, while saying how foolish the public is to demand tougher banking oversight and accountability.

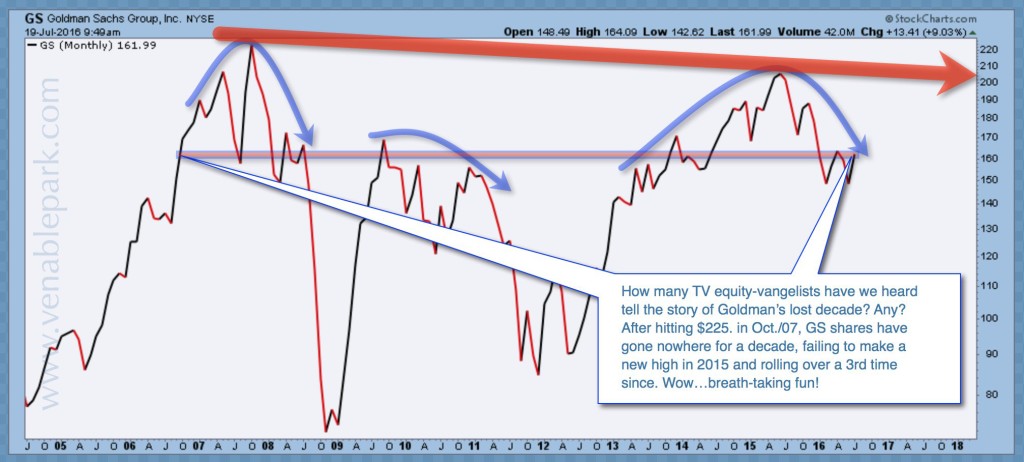

All that access to ‘free money’ and unfair advantage and still Goldman’s stock price (shown below since 2005) has gone no where in 10 years during the wild credit bubble ride it helped to engineer. Richly-priced advisors to a bevy of insolvent pensions and nations from Puerto Rico to Greece, the world will be far better off when it stops taking financial advice from ‘geniuses’ like this.