Good article courtesy of Lance Roberts this morning, in answer to the long-always propaganda suggesting that 2015 was the end of the secular bear that began in 2000 and we are now in the midst of a new secular bull market likely to continue for many more years. See: Past is prologue: new secular bull or repeat of the 70’s.

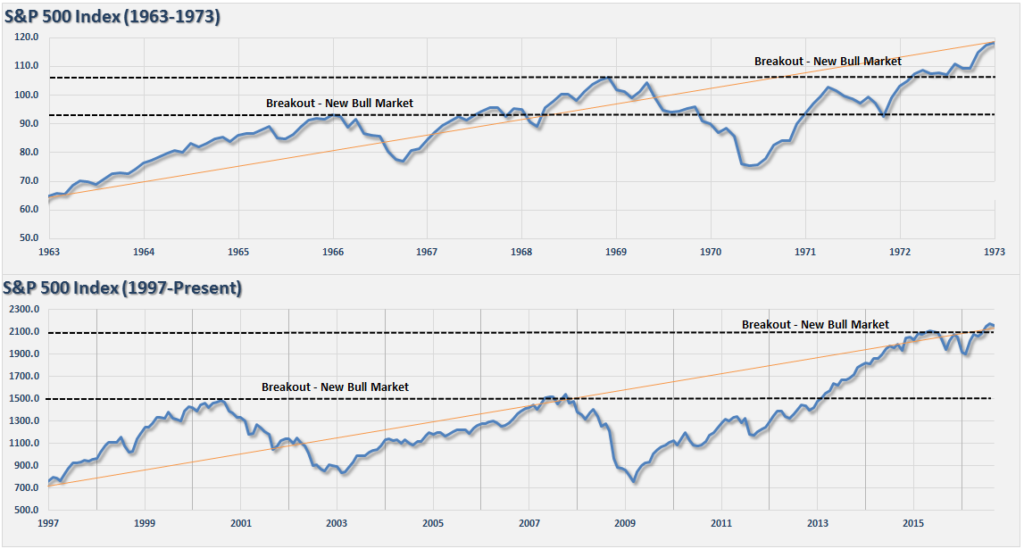

In the top panel Roberts shows the S&P 500 price action from 1963 to 1973 compared with 1997 to present in the bottom panel.

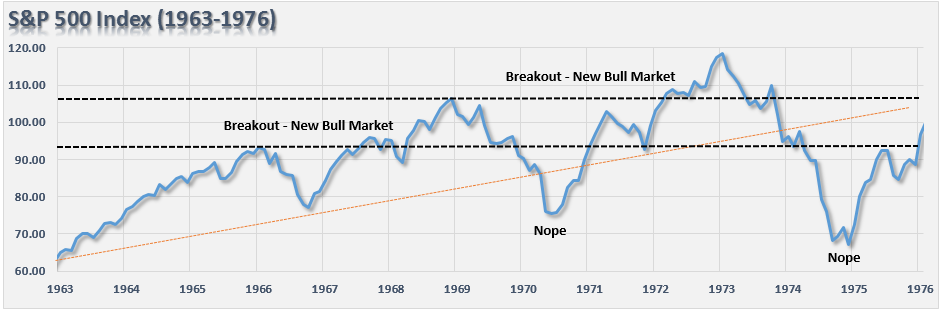

Those banking on a new secular breakout in 1972, were punished brutally for their error. What followed was a third massive decline of -45% for the broad market as shown here.

To wit:

The second breakout in 1972, like the previous, was the setup for the final market dive that reset valuation levels back to historic secular bear market lows. That crash also created the necessary extreme negative in investor psychology. The 1974 bear market low is known as a “black bear market” because investors were so brutally ravaged by the crash they did not return until nearly two decades later.

Asset valuations are more extreme and vulnerable today than at any of the 3 cyclical peaks during the 1966-82 secular bear market. Structuring our portfolio to minimize losses in the next decline, and maintain liquidity and strength of mind to be one of the few able buyers from panicking sellers, should be the wise person’s raison d’être today.