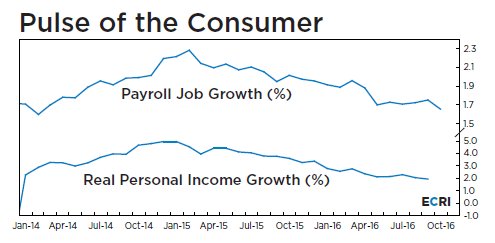

Though income growth was flat and debt levels high since the 2008 recession, auto makers and dealers were able to get product out the door by lowering lending standards, and extending loan terms (up to 8 years-double historic norms), even to those with bad credit.

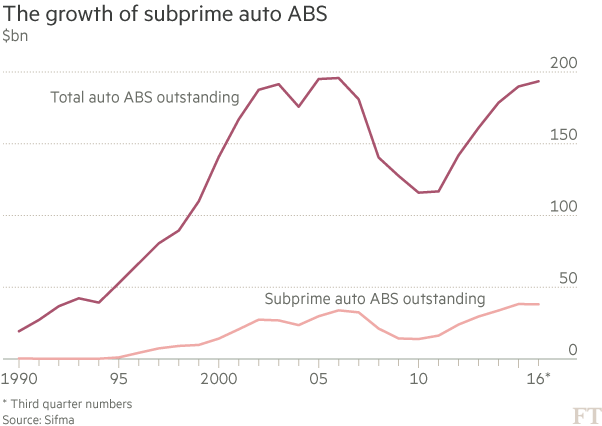

Sales growth was able to continue so long as a world awash in QE liquidity was desperate for yield and willing to gobble up packages of auto debts with a wilful blindness reminiscent of the sub-prime mortgage bubble into 2008. This chart shows the total auto asset backed securities (in red) that have been issued since 1990, with the subprime auto segment (in pink) at the bottom. The auto loan market has grown from $750bn in 2011 to $1.1tn at the end of June, according to data from the US Federal Reserve.

Sales growth was able to continue so long as a world awash in QE liquidity was desperate for yield and willing to gobble up packages of auto debts with a wilful blindness reminiscent of the sub-prime mortgage bubble into 2008. This chart shows the total auto asset backed securities (in red) that have been issued since 1990, with the subprime auto segment (in pink) at the bottom. The auto loan market has grown from $750bn in 2011 to $1.1tn at the end of June, according to data from the US Federal Reserve.

In the process, according to Experian, about 1/3 of all new-car purchases have gone to subprime borrowers who are least able to pay (credit score between 501 and 600) with interest rates of 10.4% and 72 month terms. While prime and super prime borrowers (credit scores 661 to 850) have taken terms that average 69 and 62 months respectively.

The net effect is that nearly all car buyers are now carrying long loans on depreciating assets that will make them less likely to buy another car or be free of the loan for many years to come. No free lunch here: in the process auto sales from the future are likely to be suppressed, and the inevitable loan defaults have begun to surge.

Next to follow will be loan losses for the ABS holders and knock-down effects on related debt assets. We have seen this movie repeatedly over the past decade, and it always ends in pain and trauma. See Fears rise over auto loan crisis, as repo men see sales’ dark side:

Repossessions in the US hit 1.6m in 2015, the third highest level on record for data going back 20 years, falling short of the 1.8m and 1.9m peaks seen in 2008 and 2009, respectively.

That number is predicted to rise to 1.7m this year, according to Tom Webb, chief economist at Cox’s Automotive.

Ron Neglia, T-Birds’ manager, adds that the uptick from July of this year to now has been “significant”. And that the nature of the job has shifted as well, presenting a troubling insight into the state of the current economy and for areas of the booming market for auto asset backed securities.

A year ago most of the cars that Mr Neglia repossessed were from fraudulent schemes — people renting cars under a fake name and not returning them, for example. Today, he sees a larger number of individuals simply unable to repay on their loans.