Further to the vulnerability in insanely valued, heavily levered Canadian housing today, real estate investment securities reflect potentially even greater downside risk. After all, at least you can live in housing as the price goes down (if you can maintain the payments), but for those holding real estate investment trusts (REITs), plunging price has no offsetting consolation or utility–just capital losses and mental torture.

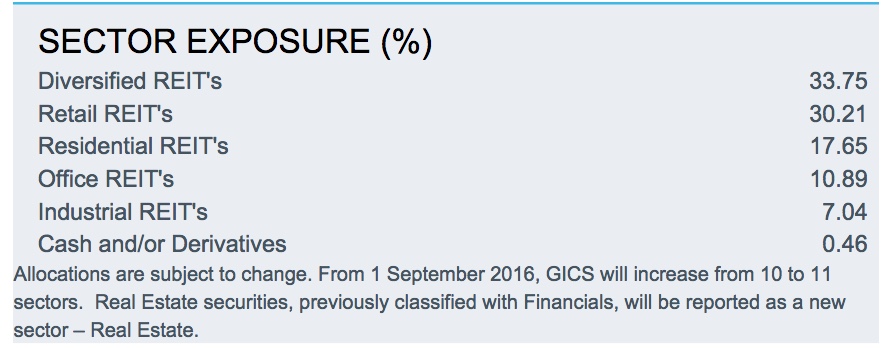

As shown here on the Blackrock website, the Canadian (XRE) REIT reports a mix of realty types but as CMHC has pointed out, a downturn in Canadian home prices should be expected to spike unemployment and lead to an overall recession which will have knock-down effects on other wildly over-built areas like retail and office. (Diversified REIT’s are just those who do not break out their specific weights in each of the sectors).

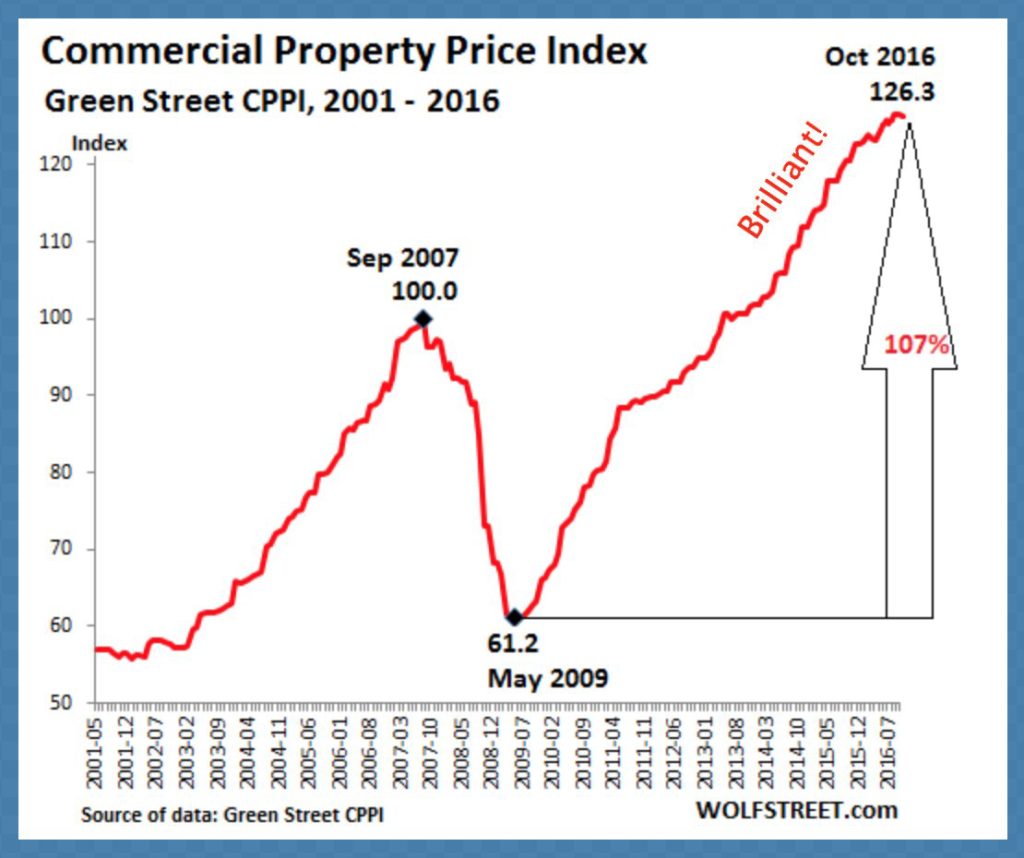

Here is a chart of the US commercial property index to get a sense of how far prices have lept since 2009.

Below is my partner  Cory Venable’s chart of the Canadian real estate investment trust (XRE) since 2002. Arguably even more than 2008, price risk is u-u-u-g-e at the moment. On the other hand, a mean reversion of 30 to 50% would go a long way in increasing yield and restoring investment prospects once more. Unfortunately those who have been buying these securities in search of income the past few years, will be side-swiped. Wise to wait on the sidelines for now. Much better entry points are likely as this cycle completes.

Cory Venable’s chart of the Canadian real estate investment trust (XRE) since 2002. Arguably even more than 2008, price risk is u-u-u-g-e at the moment. On the other hand, a mean reversion of 30 to 50% would go a long way in increasing yield and restoring investment prospects once more. Unfortunately those who have been buying these securities in search of income the past few years, will be side-swiped. Wise to wait on the sidelines for now. Much better entry points are likely as this cycle completes.