If only valuations didn’t matter and the price paid for financial assets did not define investment returns. Then we could always confidently buy and never worry–how awesome would that be?

If everyone could buy at every price and only make profits, then we would all be well off (most aren’t) and pensions and retirement funds would not have deficits (but most do).

While Central Bankers and other finance types talk in theory, the populace lives in a reality where savings are hard to amass and easy to lose.

We are living in a time when risk and return prospects across the world’s asset markets have rarely, if ever, been worse. Most dangerous of all, in this extend and pretend era, the most willfully blind, reckless and unscrupulous participants appear to have the answers. As usual, false prophets and misguided thinking will not be revealed until capital devastation has already hit. John Hussman summarizes in Complacency and the Fat Left Tail:

Presently, we observe wide internal market dispersion, including weakness among interest-sensitive securities, tepid uniformity across developed markets, and an abrupt whack to technology stocks last week. The combination of a steeply overvalued, overbought, overbullish market with hostile yield trends and divergent internals is not one we take lightly. It’s that combination that has most often been associated not only with emerging bear markets but with market crashes.

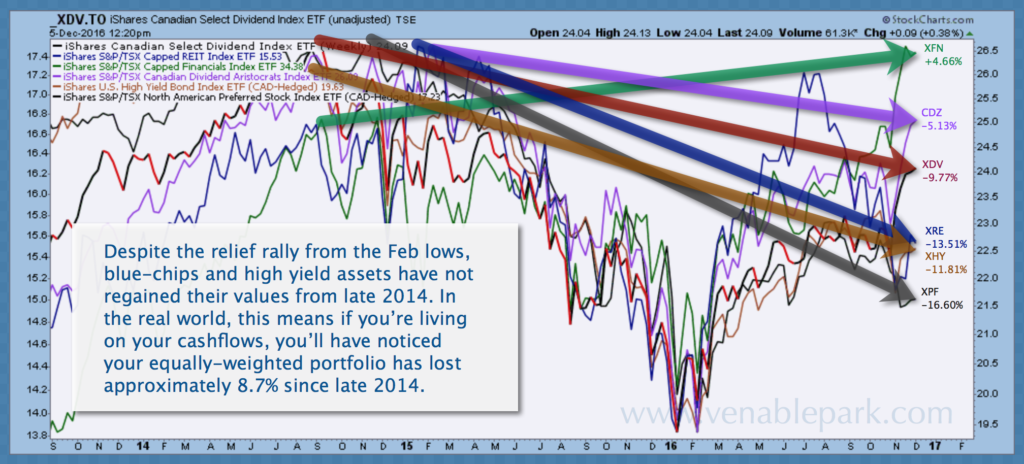

The below chart from my partner Cory Venable, offers an overview of the ‘weakness among interest-sensitive securities’ mentioned in Hussman’s quote above. After plunging into February 2016, everything bounced together over the past few months. Still only credit-delirious Canadian financials have managed to eke out some marginal price progress on borrowed time (XFN in green).

The other ‘defensive’ income favorites like utilities, REITs and preferred shares have lost value since 2014, as holders have collected some dividends and hoped their capital was secure. Unfortunately it’s not, and the looming downside for irrationally priced assets is not something that mere mortals can afford to bear, no matter what they may believe at the moment.