There was QE 1, 2 and 3 euphoric rallies in risk appetite–2009, 2010 and 2013– then there was one measly .25 Fed hike last December and depression resumed again to early 2016 as stocks, corporate debt prices and commodities all slumped (what diversification benefit ?) while investment grade bonds and the US dollar bounced once more. In recent months, big financial and energy stocks have led a risk asset rebound to breath-taking heights once more, as investment grade bonds dropped.

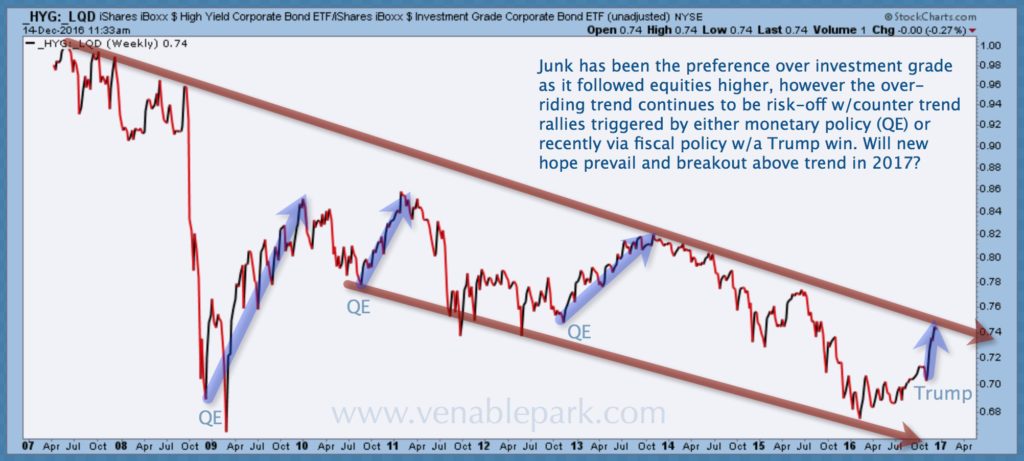

Now as shown in this updated chart of the price change (stripped of income) for the high yield bond index ETF (HYG) versus the investment grade index ETF (LQD) since 2007, we are back at the upper end of the downward trend in risk appetite which has prevailed in fits and starts since 2007. The verdict: risk-off still in charge so far. Will a second hike from the Fed today, be fuel or smelling salts for mindless trading algos? Stay tuned…