Risk markets have roared since November on hopes of quick fiscal stimulus courtesy of Trump & co and high frequency traders gunning for light-speed. We note that Canada elected our new government more than a year ago on similar promises and so far Infrastructure delays keep Canada’s spending lagging behind budget plans. Devising, approving, structuring and executing fiscal stimulus is hard to do well, and no quick turnaround for large economies, even when accomplished. This is especially true where a country is already heavily indebted and governments have to borrow tons more to pay for planned spending. In such cases, negative not positive growth multipliers, are more likely than not, in the end. That’s just the math.

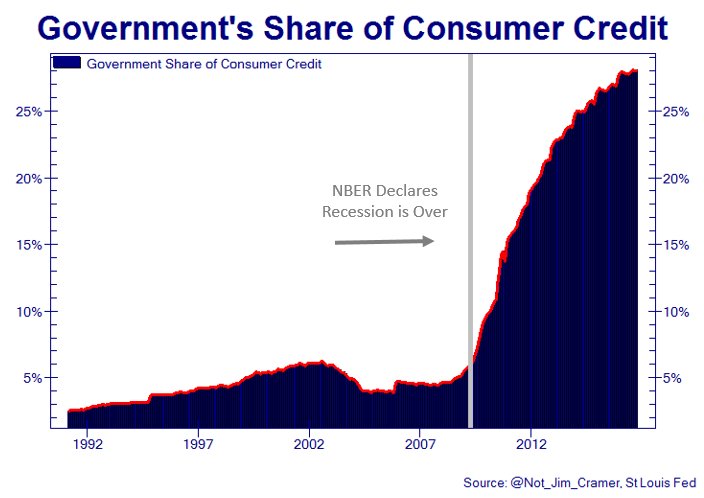

Lest we forget, having governments bail out reckless borrowers and lenders is how our financial leaders opted to sta ll the 2008-09 great recession and we are all paying the price. This chart of US government’s share of consumer credit via auto, student and housing debt underwriting shows the pattern since the last recession. Most major economies in the world did variations of the same. All to spare institutional lenders from suffering the defaults they deserved.

ll the 2008-09 great recession and we are all paying the price. This chart of US government’s share of consumer credit via auto, student and housing debt underwriting shows the pattern since the last recession. Most major economies in the world did variations of the same. All to spare institutional lenders from suffering the defaults they deserved.

Today those with savings to lose, must stay lucid and realistic and discern hyperbole from overly confident politicians, business execs and risk-sellers, from the cyclical big picture for markets and the economy. A few updated charts from my partner Cory Venable offer some overview.

First, the US 10-year Treasury Yield is here since 1988. After rallying back to resistance since the fall, we remain at least so far, still in a downtrend, as deflationary forces are formidable, entrenched and indeed the historic norm outside of war times. The investment grade bond bull was wounded the past few months–but may not be dead yet.

A similar story is told here in the price of copper (shown since 2007). Trump rally notwithstanding, so far, deflationary trend remains unbroken.

Next we have the great re-inflation narrative of global stock bulls, here captured in the FTSE All World Index since the US consumer credit bubble burst in 2007 (and the debts were downloaded onto government balance sheets). Flopping wildly since 2014, this global index shows no breakout to refute the thesis that the cyclical –and perhaps secular top–of this leverage-mad era has already come and gone.

Lastly, we have the great commodity surrogate the Canadian dollar, here also since 2007. After peaking on the same infamous US consumer-credit-driven-demand-bubble into 2008, the loonie rallied on stimulus hopes into 2011 and then dove all the way into early 2016. A secondary rebound stalled last summer, and since then, the C$ has not confirmed ‘Trumphoric’-faith in a new expansion cycle. Not yet anyway. Best to stay sober and alert.