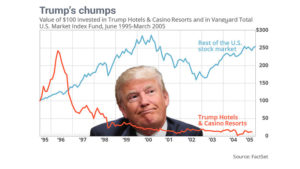

There is yet another important reminder to public market investors in the Trump business history: the stock and corporate bond market exist to cash out founders by distributing shares and debt to the public. Those who receive the cash win big, those left holding the securities often end up losing. With all the hype and hope it is easy to forget this, but we do so at our financial peril. If we are going to play this game, then avoiding when prices are high and buying only after they have plunged is key to survive and thrive. See: Donald Trump was a stock market disaster:

It is already well-known that Trump’s businesses have passed through Chapter 11 four times over the past 25 years. Creditors have lost billions along the way. But as most of this has involved complex debt arrangements between Trump, his various business entities and dozens of banks, the details can easily get lost in the shuffle. Trump himself says he has merely been “smart” to use the corporate laws — including the bankruptcy code — to his advantage.

But the stock market is a little different. The losses are very public and very easy to follow — and the losers are ordinary investors who bought the stock directly or through mutual funds. Even worse, many of those investors are voters, too.

All in all, it’s a lucky thing for Trump that the public is so easily distracted … and have such short memories.

Also see this direct video link.