Someone recently told me that they worked hard for their money and they would like to see their money work hard for them. This reminded me of Michael Lewis’ analogy that financial sales propaganda has conditioned people to think of their savings as a dog team that must be whipped and abused to make it move faster. The truth is the opposite: only discipline and care in building savings and then defined standards and patience in selecting how and when to invest it, are likely to grow financial strength over our lifetime.

Since most asset prices in the world are egregiously overpriced today, the income yields available on them are low with a high risk of capital loss. The best course given these facts, is not to care less and risk more, but to raise liquidity and strategically wait for better opportunities to present. Instead many people are doing the opposite. “I need more income”, is a common complaint today, but the truth is, most need more capital. Holding on to overvalued assets to try and squeeze out extra income is a time worn path to financial hardship. This week’s letter from John Hussman is worth reading. See Blue Skies:

In April 2000, I described the psychology that investors could expect to play out over the completion of the market cycle:

“This is my retirement money. I can’t afford to be out of the market anymore!”

“I don’t care about the price, just Get Me In!!”

“It’s a healthy correction”

“See, it’s already coming back, better buy more before the new highs”

“Alright, a retest. Add to the position – buy the dip”

“What a great move! Am I a genius or what?”

“Uh oh, another selloff. Well, we’re probably close to a bottom”

“New low? What’s going on?!!”

“Alright, it’s too late to sell here, I’ll get out on the next rally”

“Hey!! It’s coming back. Glad that’s over!”

“Another new low. But how much lower can it go?”

“No, really, how much lower can it go?”

“Good grief! How much lower can it go?!?”

“There’s no way I’ll ever make this back!”

“This is my retirement money. I can’t afford to be in the market anymore!”

“I don’t care about the price, just Get Me Out!!”My view today is the same I expressed in December 1999: “One thing is certain. This market cycle will be completed by a bear market, and a potentially violent one. Of course, nobody thinks about market cycles anymore. Nobody imagines that stocks can do anything but advance. And in the mania of the present, it is easy to forget the nearly identical ones of the past, and their very, very bitter aftermaths.”

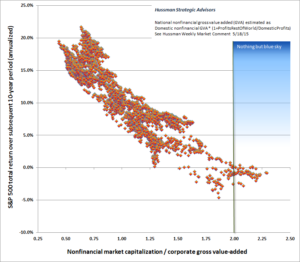

Hope is not a strategy. The facts are that since 1947, no incidence of equity valuations near present levels has ever produced positive investment returns over the following 18 months, 3, 5 or even 10 year holding period. The green line below, marks the current market valuation of S&P 500 companies compared with other historic periods and the subsequent return 10 years later (left axis): zero and negative in every instance.

“Every investment approach has its season, and my impression is that passive investment strategies are approaching the start of a very long, hard winter. We fully expect patient, diligent passive investment in the S&P 500 to be rewarded with nothing over the coming decade.”

“Every investment approach has its season, and my impression is that passive investment strategies are approaching the start of a very long, hard winter. We fully expect patient, diligent passive investment in the S&P 500 to be rewarded with nothing over the coming decade.”

Not a good trade.