After losing ground in 2008, 2011 and 2015, North American equity markets moved higher in the second half of 2016, and buy and hope has become popular again. Nine years since the last cyclical bear market began however, the next is overdue, and would-be investors should be risk-averse and cautious. Instead, most participants have become complacent, willfully blind and unduly confident once more.

As pointed out by Peter Boockvar this month, the current spread of 61.2% of bulls in the weekly Investors Intelligence Survey versus bears of just 17.5%, has only been seen a few times over the past few decades, all at, or near, cycle tops.

The truth is that, typical of previous secular bear periods, over the past 20 years, markets have spent most of their time making back cycle losses, rather than making net gains. And therein lies the rub of massive overvaluation periods. We can buy and hope, but we can’t make back the time and angst wasted in our efforts to grow our savings.

Here is a snapshot of the Canadian TSX since 2008, prices spent the entire 8 years to October 2016 within the red box, just trying to recover prior cycle losses. And even this poor performance took 8 years of unprecedented policy intervention and trillions in central bank injections, to coax. The next plunge into the red, will take prices back below 2008 levels once more. Then what help will buy and hold strategies and products boast?

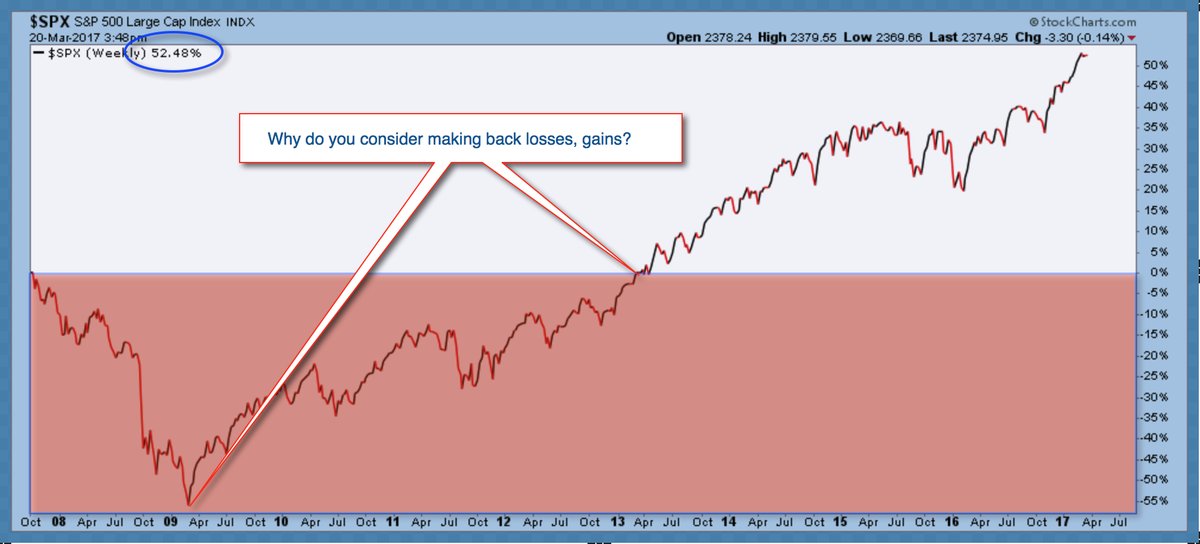

Next is a similar look at the S&P 500 since 2007. This red box highlights the 5 1/2 year period from October 2007 to April 2013 which holders had to waste, trying to make back the 2007-09 cycle losses. Again, another dip into the red box is now overdue. And with holders 10 years older than in 2007, they will have even less time and patience to wait for the next recovery after that. Making matters worse, asset prices typically take a full 10-20 years to reclaim their previous cycle peak once a secular bear has completed. This means that the market peaks of 2007 and 2016, may not be revisited until 2027, or even later.

Beware of all the passive managers, funds and ETFs, boasting of long always strategies again today as they did in 2000 and 2008 They are due to look dumb and reckless once more.