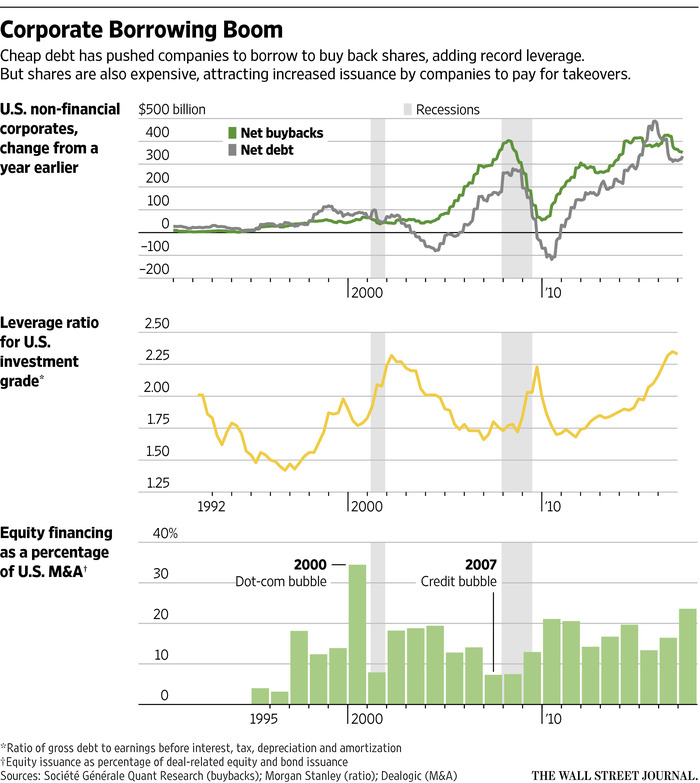

Whether they’re aware or not, debt-gorging consumers and businesses have all been banking on the same unreasonable assumption: that consumption/sales and wages will increase and economic growth continue to expand, without a downturn, indefinitely. But more than 8 years since the last recession, that bet faces increasingly unfavorable odds. And having used the extra-long expansion since 2009 to accumulate record debt, rather than pay it down, fall back plans are now generally non-existent. Not good financial or business planning. No expansion cycle can last forever, especially one this dependent on adding more debt. See: Not a Dot-Com Bubble, Not 2007, But a Nasty Mix of Both.

This chart showing the leverage on corporate balance sheets today, versus the past cycle peaks in 2000 and 2007, is not a picture of strength and resilience.