This weekend in my home town of Barrie (1 hour north of Toronto), I spoke to three people who reminded me of the compound costs of Canada’s latest debt-fueled real estate mania and why it is unsustainable.

The first was a 22 year old esthetician who also moonlights at the beer store. She had graduated from a college based training program in 2014 with $30,000 in student debt. She has been working two jobs, 6 days a week, since. So far she continues to live in the same student rooming house she has been for the past 3 years, paying $550 a month for a room and shared living quarters with 4 other students. She no longer qualifies to stay there, and has to move out by August. For more than a year, she and her boyfriend have been looking, but unable to find, an habitable apartment for less than 1500 a month including utilities. It has to be on the bus route, they own no car. They are now hoping a friend can find a job in the area, so that the three of them together can afford to rent a 2 bedroom apartment.

The second was the 30-something owner of the aesthetics business. She is married with a 4-year old son, and her husband also works full time. They have been renting and trying to save a down-payment for a starter house. They are looking for enough space that her aging mom can live with them and help with child care. Last year they were excited to find a new subdivision being built 15 minutes outside of town on 40 foot lots. They tried to find a way, but at 650,000 plus taxes and utilities, on top of a car and child care costs, they could not stretch enough to cover all the payments. They have kept trying to build their savings, but this spring she says, those 650K homes are selling for over a million, up some 400k in 1 year. They now feel utterly hopeless about ever being able to buy a home.

The third, was a 50 something, government worker who goes to my gym. In the past couple of years, he gutted the equity in his personal residence to buy 8 other rental properties with minimum down-payments after taking a real estate ‘investment’ course taught by self-styled real estate guru Scott Mcgillevray (who is sponsored by debt-seller CIBC). The rents don’t quite cover his carrying costs for the properties, so he is subsidizing with money from his employment on top of paying his own home mortgage. But he feels it’s worth it, because prices are only going up!

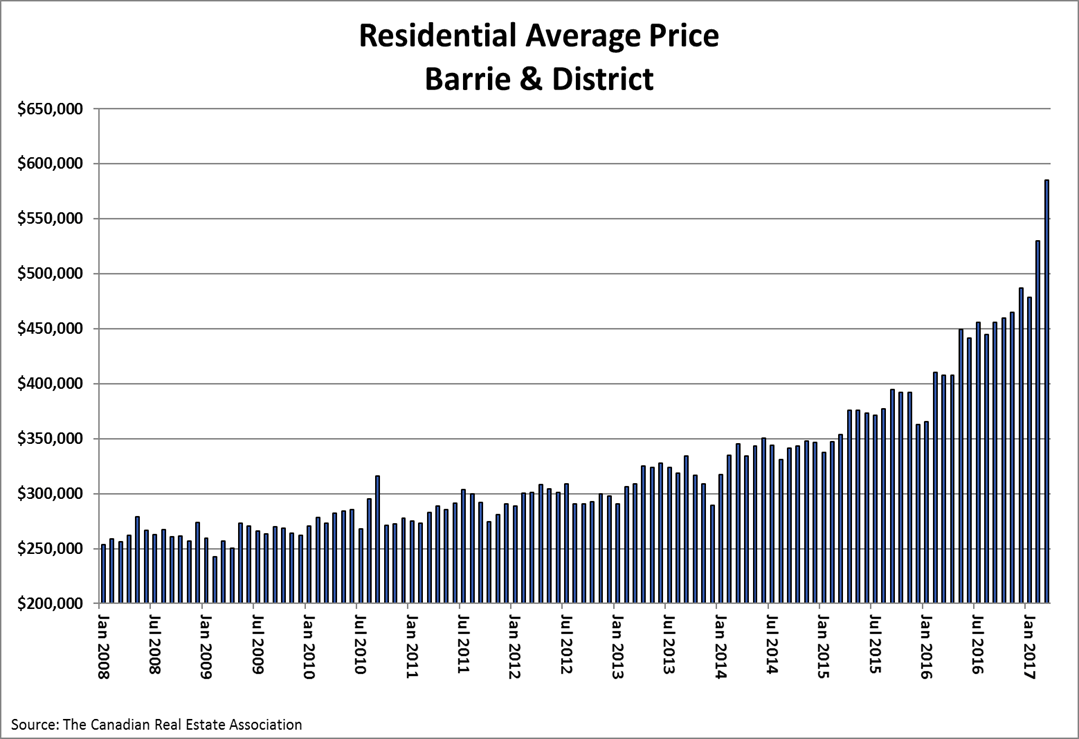

This is the Canadian real estate association’s chart of home prices in Barrie since 2008. The average price has more than doubled. Incomes have not. Affordability has been completely dependent on the availability of credit. Increasingly buyers have been high- ratio (5 to 10% down, 95 to 90% financed).

Rates are, so far, still less than 3% for most prime mortgage terms, but the banks have been increasing their credit card rates over the past few months (now over 20% for most), and last week TD sent out notice that is was raising its personal line of credit rates by 3%. Yes, prime plus 4.5% from 1.5%, takes PLC rates from 4.2% to 7.2% starting on May 25. Most Canadians today are carrying revolving debt on credit cards and lines of credit, on top of car loans/leases, student loans, mortgages/rents and everything else.

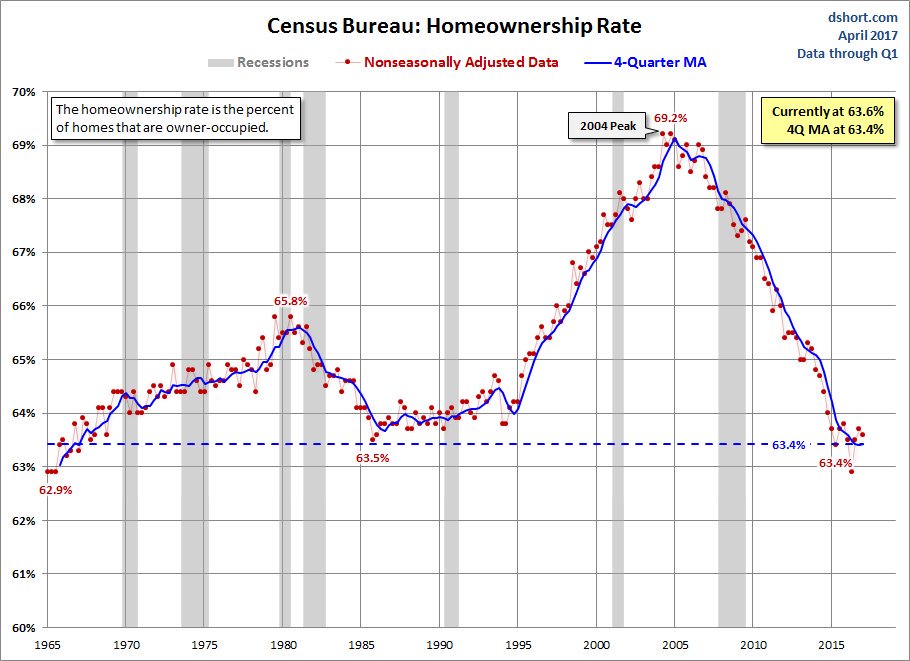

Low rates and ‘creative’ financing over the past 8 years in particular, have enabled Canada’s home ownership rate to reach an unprecedented 70%, compared with the long term average of about 64%. The below chart shows what happened to the US homeownership rate after it soared to 69.2% in the subprime lending bubble in 2004-05. Note that is has since reverted to the long term average of 63.4%. It is highly likely that Canada will follow suit, and the buyers who bought, but shouldn’t have, the past few years, will default and return to renting.

This reversion to the mean in prices and ownership rates is essential to restore affordability to shelter costs in Canada. It will happen because, mathematically, it must. The hard part will be that after the oil-rush, a now debt-addicted Canadian economy, is precariously levered to real estate as its last cylinder of growth. See: Life after oil makes real estate Canada’s new economic crutch.

Lower prices will help restore financial viability in the longer run for those needing shelter (that’s everyone, BTW), but not without defaults, liquidation, capital losses and economic challenges in the process. This is the bed we have made, the payback period is coming next.