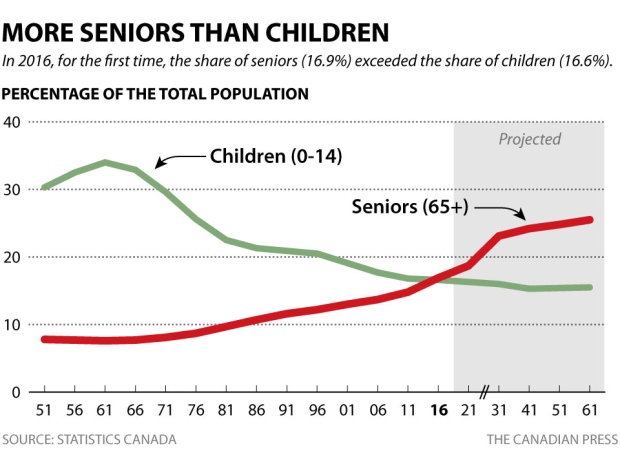

It’s official, as of the 2016 census released today, Canada now has more citizens over the age of 65 than under the age of 15. See: Canadian seniors now outnumber children for the first time. Here is the chart, showing the cross over last year, and the projected spread set to widen over the next 45 years.

At current birth, death and immigration numbers, a full 23% of the Canadian population is projected to be seniors in just 14 years, on par with Japan today–the world’s ‘oldest’ population where retirees are no longer net savers, but already net-sellers of financial assets and real estate in order to raise cash for living expenses. Near zero investment yields are accelerating the need for retirees to consume savings in Japan and most of the world.

At current birth, death and immigration numbers, a full 23% of the Canadian population is projected to be seniors in just 14 years, on par with Japan today–the world’s ‘oldest’ population where retirees are no longer net savers, but already net-sellers of financial assets and real estate in order to raise cash for living expenses. Near zero investment yields are accelerating the need for retirees to consume savings in Japan and most of the world.

As in most wealthy countries, the average number of live births for Canadian women at 1.59, is less than the 2.1 needed to maintain, let alone grow the population. Only more immigration can soften the rate of decline in our working age to total population ratio, and immigration has become increasingly unpopular with the masses.

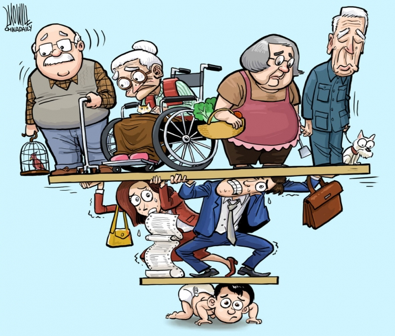

The trends do not bode well for consumption demand, nor the many income, benefit programs and subsidies, that are dependent on worker contributions and taxes.

The trends do not bode well for consumption demand, nor the many income, benefit programs and subsidies, that are dependent on worker contributions and taxes.

Less income, less wants and less spending, are all part and parcel of a population naturally inclined to downsizing, lowering expenses, and moving to elder-friendly residences.

The defining question for the real estate frenzy that’s driven an estimated 84% (Scotiabank) of Canada’s economic growth over the last 6 years then, is who will buy our present concentration of single-detached homes (53.6%, see bel0w) full of old-tech energy and efficiency systems, presently trading f ar, far, above reasonable affordability and income multiples, amid escalating taxes of every kind?

ar, far, above reasonable affordability and income multiples, amid escalating taxes of every kind?

What about foreigners looking to park money in Canadian assets, can’t they ‘buy it all’ and save the day? Doubtful for many reasons, but lest we forget: the ones with the buying power are also predominantly of the same aging demographic. They can’t be voracious forever. In all these circumstances, it’s hard not to see, today’s lofty asset prices must have a target on their bubble.