Dramatically under-pricing capital risk has been the hallmark of the last 20 years of the most interventionist monetary policy in human history. Increasingly more reckless capital allocations have led to three successively larger financial bubbles–punctuated by two global busts to date–in 17 years. The present (third) bubble is the biggest yet, and has infected every asset class. One of the most obvious indicators of present risks can be found in the leveraged loan market–the same products that triggered the 2007-09 collapse–only this time, it is much larger.

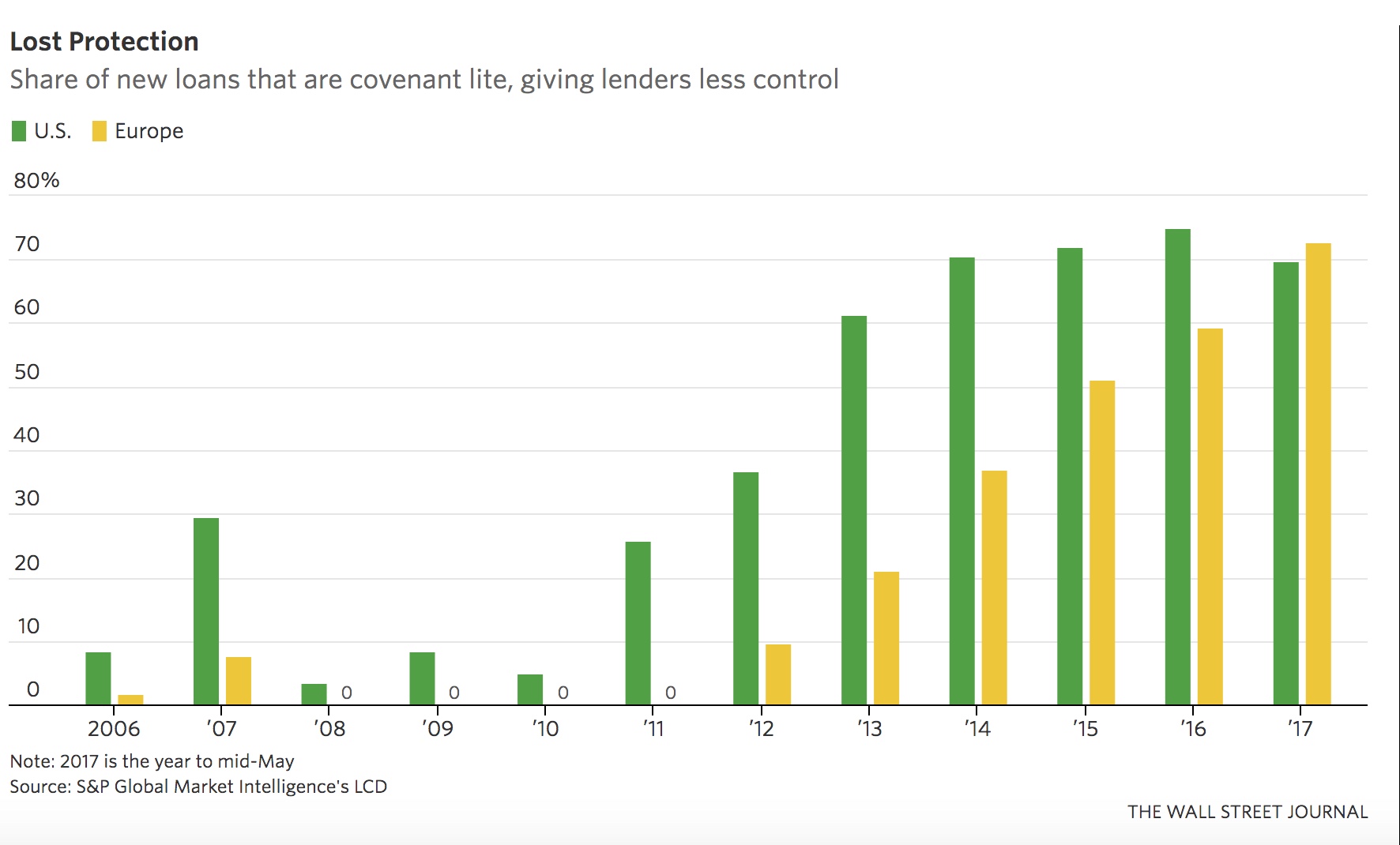

To wit: in 2007, just under 30% of U.S. loans and 8% of European loans were covenant lite, according to S&P Global Market Intelligence’s LCD research unit. Last year almost 60% of European deals and 75% of U.S. de als were covenant lite. Superfluous capital desperate for yield has been throwing itself into the certainty of capital losses. Here is the chart from the Wall Street Journal. See Hunt for yield is driving loan investors crazy:

als were covenant lite. Superfluous capital desperate for yield has been throwing itself into the certainty of capital losses. Here is the chart from the Wall Street Journal. See Hunt for yield is driving loan investors crazy:

Leveraged loans are popular because they pay higher yields than investment-grade bonds, are secured against borrower assets and give investors protection from changes in underlying interest rates. But they are also relatively risky because borrowers are usually heavily indebted.

Lenders used to get extra protection by attaching conditions to the loan, known as covenants, which allowed them to take action if a borrower’s earnings deteriorate, for example. These days, most loans are “covenant lite” meaning lenders get less influence over a borrower’s actions.